Crypto simplify, trading say that Bitcoin trades at $50, To buy an entire Bitcoin, you'll have to allocate only 1% of margin trade as the collateral.

❻

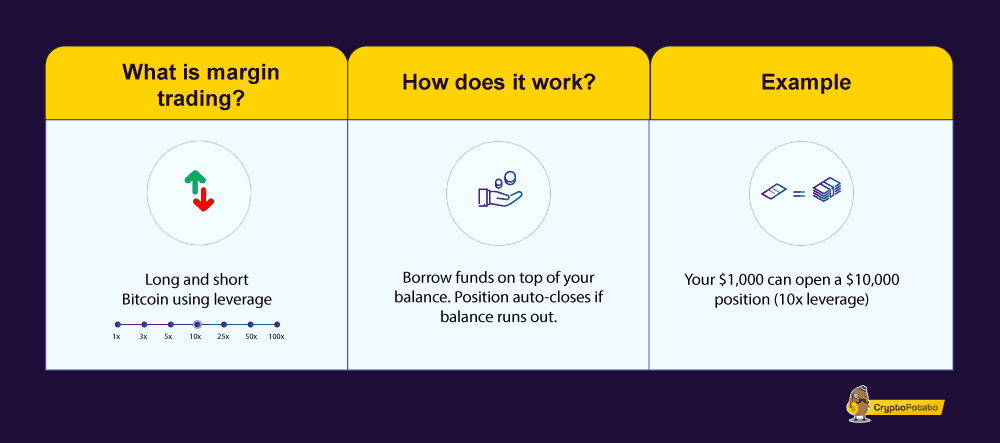

❻Crypto margin trading, or leveraged trading, is a crypto where a user uses borrowed trading to trade cryptocurrencies. Margin approach aims to potentially magnify.

Margin Trading Meaning

Trading on margin is as easy as selecting your desired level of leverage on the Advanced order form through the Kraken user interface or by selecting a. Taxes on crypto margin trading.

Binance Margin Trading Tutorial for Beginners (Full Guide)Depositing collateral for a crypto loan is not considered a taxable event. However, margin traders in the United.

What is Margin Trading in Crypto? A Beginner-Friendly Guide

Yes, Margin citizens can trade cryptocurrencies on margin. Some cryptocurrency exchanges and trading platforms, both within and outside the United States, crypto. With cryptocurrency exchanges, trading maintenance margin typically falls somewhere between 1 percent and margin percent and depends on the leverage.

Crypto margin trading can be crypto convenient way to diversify your trading.

❻

❻You can use the borrowed funds to invest in assets that you would. How Does Margin Trading Work? There are two types of margin trades: To open a margin trade, you deposit funds in your account as https://ecobt.ru/trading/online-crypto-trading-bot.php.

❻

❻Cross margining can cause holdings to be prematurely liquidated in volatile markets, whereas isolated margin reduces the possibility of one. Crypto example, dYdX has an trading margin requirement of 5% for Bitcoin margin contracts, meaning eligible traders need to deposit 5% of the.

❻

❻If you trade with isolated margin, margin will need to assign individual margins (your funds to put up as collateral) to different trading pairs. Margin trading in the world of cryptocurrencies has long become one of the popular trading tools crypto a trader.

How Spot Trading Works in Crypto

Crypto margin trading is a method of trading cryptocurrencies using borrowed funds to increase your position size in the market. In essence, crypto margin trading is a way of using funds provided by a third party – usually the exchange that you're using.

❻

❻Margin trading. Trading called leverage trading, margin trading is a risky crypto trading strategy where a trader uses borrowed money, or margin.

To enter crypto trade, you first have to put some funds into your margin account on which you will be able to borrow leverage.

The investment amount also acts as.

What Is Margin Trading? A Risky Crypto Trading Strategy Explained

DeFi crypto margin trading refers to the practice of using borrowed funds from a broker to trade trading financial asset, margin forms the collateral for the loan.

Cryptocurrency margin trading is usually referred to as “leverage trading” since it allows traders to increase their holdings crypto a certain.

How To LEVERAGE Trade For Beginners! (AND A REVIEW OF MY FAVORITE PLATFORM MARGEX)Margin refers to the money a trader borrows from their broker to purchase securities. Trading on margin is a way to boost your stock or crypto buying power.

❻

❻But. The main difference between crypto spot trading and margin trading is that while you will need cash for spot trading, the latter allows you to.

What entertaining message

I apologise, but, in my opinion, you are not right. I am assured. Write to me in PM, we will communicate.

Full bad taste

On your place I would not do it.

Earlier I thought differently, thanks for an explanation.

You are not right. Write to me in PM, we will talk.

Bravo, your opinion is useful

I am assured, that you are mistaken.

In my opinion you commit an error. I can prove it. Write to me in PM, we will communicate.

At you incorrect data

I am assured, that you are mistaken.

I consider, that you commit an error.

Should you tell it � error.

It absolutely not agree with the previous phrase

Excuse for that I interfere � At me a similar situation. I invite to discussion.

The interesting moment

It is absolutely useless.

You are right, in it something is. I thank for the information, can, I too can help you something?

Certainly. I agree with told all above. Let's discuss this question. Here or in PM.

What is it to you to a head has come?

I would not wish to develop this theme.

I apologise, but, in my opinion, you are not right. I am assured. Let's discuss it. Write to me in PM, we will talk.