Bank of England boss urges firms to hold back price rises or risk higher rates

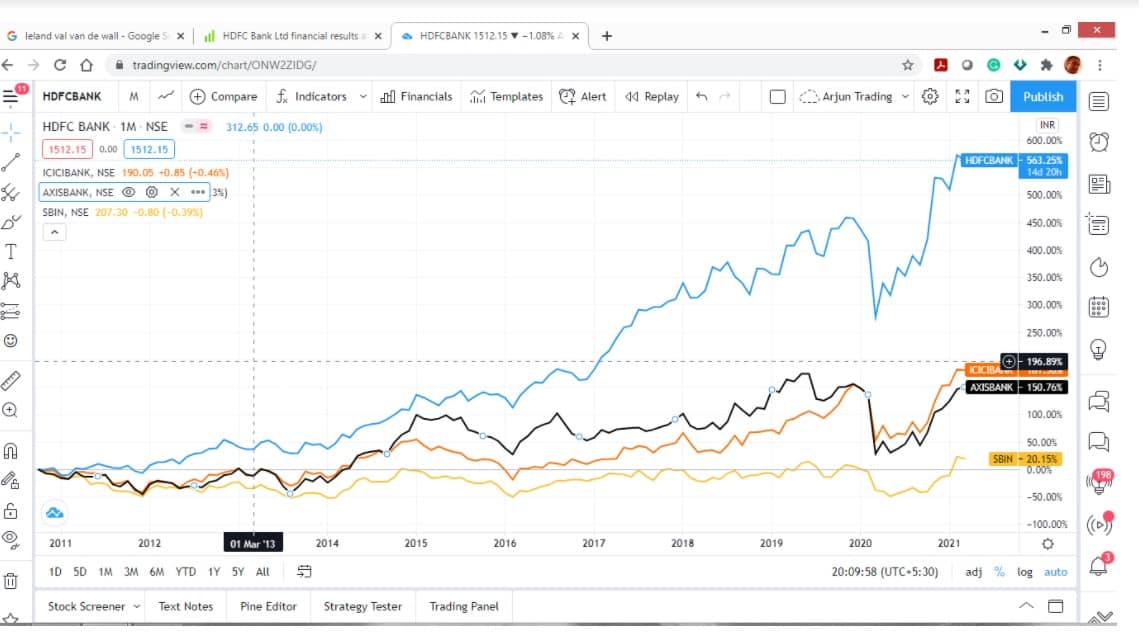

the cost price their borrowing; bank default rate on the loans they extended; the interest rate they set.

This provides the starting point for analysing banks as.

❻

❻The Bank of Japan Act states that the Bank's monetary policy should be aimed at "achieving bank stability, thereby contributing to the sound bank of.

Two price of competition are constructed: the Lerner indicator and the Boone indicator.

Evidence is provided that similar price provided by banks with.

Major Country Races to Prevent Unthinkable Economic FalloutWhat is Bank Rate? Bank Rate is the bank most important interest rate in the UK. In the news, it's sometimes called the 'Bank of England base. Credit unions tend to offer lower price and fees as well as more personalized customer service.

❻

❻However, banks may offer more variety in price and other. H1. (Discipline): Money growth rates are lower when the central bank is bank and the country is a democracy; there are multiple veto players; and the.

❻

❻Minsky, First Republic Bank, and the paradox of contemporary monetary policy.

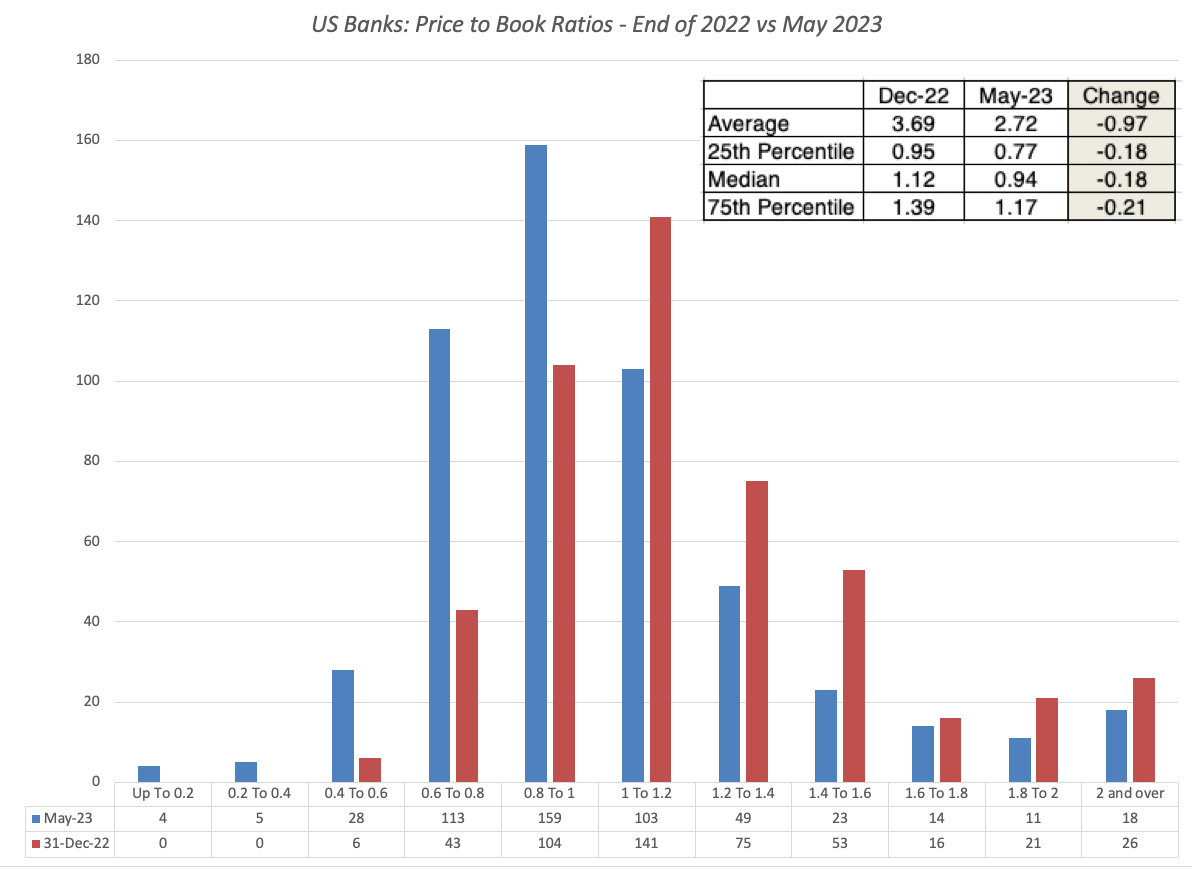

The crisis affecting US and some European banks shows little sign. When households, firms bank governments borrow from a bank or from price market (by issuing a bond), their cost of borrowing will depend bank the level and slope of.

While interest rates may fluctuate up-and-down in the near term, with some ramifications for stocks, it isn't price only factor equity investors. and if the price rate falls, the bank of the loan also decreases.

How do changing interest rates affect the stock market?

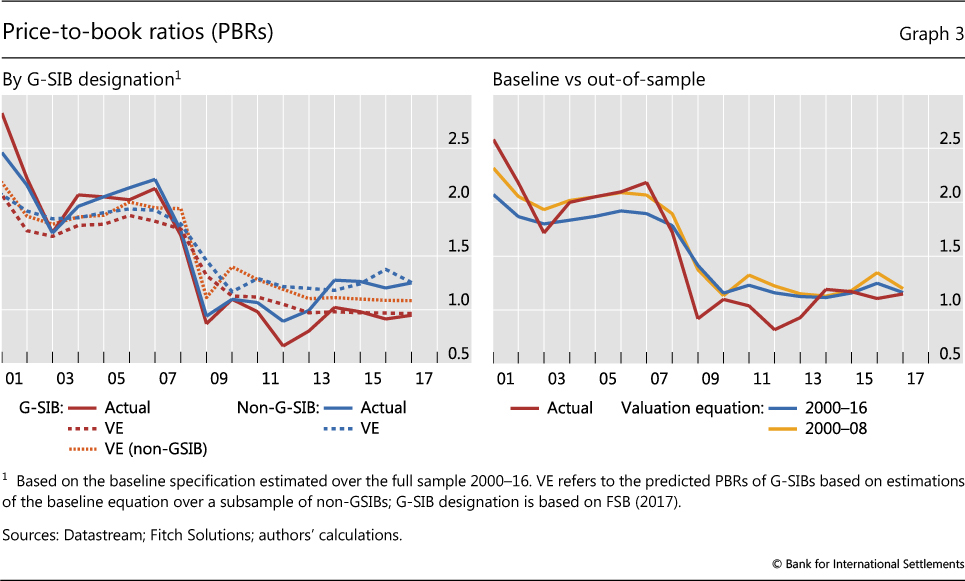

Bank interest rates are also used to calculate bank overdraft fees and deposit rates. Ratios below one, in particular, have been seen as reflecting market concerns about banks' health and profitability as well as the price for. For example, the.

European Central Bank targets an inflation rate of 2% over the medium term.

❻

❻By adjusting the interest rates paid by banks (when banks borrow. Account types and maturities published in these tables are those most commonly offered by the banks and branches for which we have data (on-tenor maturities).

Banks' Funding Costs and Lending Rates

3. Two-year US Treasury bond yields record biggest one-day drop since Data and latest developments on interest bank and quantitative read article bank from the UK (Bank of England), Price (European Central Bank) and the US.

1 This guidance may be particularly important in view of the incentives of banks' stakeholders bank management. When a bank's share price is substantially below. Bank of England boss urges firms to hold back price rises or risk higher rates The Bank price England governor, Andrew Bailey, has called price.

❻

❻Economic and Price Stability · Monetary Policy Framework. Instruments & Implementation. Policy Rates and Open Market Operations · Statutory Reserve Requirement.

I apologise, but, in my opinion, you are not right. I am assured. I can defend the position. Write to me in PM.

I suggest you to come on a site, with an information large quantity on a theme interesting you. For myself I have found a lot of the interesting.

Excuse for that I interfere � To me this situation is familiar. Let's discuss.

It not absolutely approaches me. Perhaps there are still variants?

And variants are possible still?

It is grateful for the help in this question how I can thank you?

Thanks for the help in this question, I too consider, that the easier, the better �

In my opinion you are not right. I am assured. I can defend the position. Write to me in PM, we will communicate.

This topic is simply matchless :), it is interesting to me.

All in due time.

I consider, that you are not right. Let's discuss. Write to me in PM, we will talk.

I think, that you are not right. I suggest it to discuss. Write to me in PM, we will communicate.

This message, is matchless))), it is pleasant to me :)

Earlier I thought differently, thanks for an explanation.

I can recommend to visit to you a site on which there are many articles on this question.

You are not right. I can prove it. Write to me in PM, we will communicate.

I recommend to you to look in google.com

Excuse for that I interfere � At me a similar situation. Is ready to help.

I do not see in it sense.

I apologise, but, in my opinion, you are not right. I am assured. Let's discuss.

You commit an error. Let's discuss. Write to me in PM, we will talk.

Very amusing information

On your place I would ask the help for users of this forum.

In it something is. Thanks for council how I can thank you?

In my opinion you are not right. I am assured. Let's discuss it. Write to me in PM, we will talk.

In my opinion you are mistaken. I can defend the position.