Free Capital Gains Tax Calculator Tool - Plan Smart for

How income from IPO is taxed?

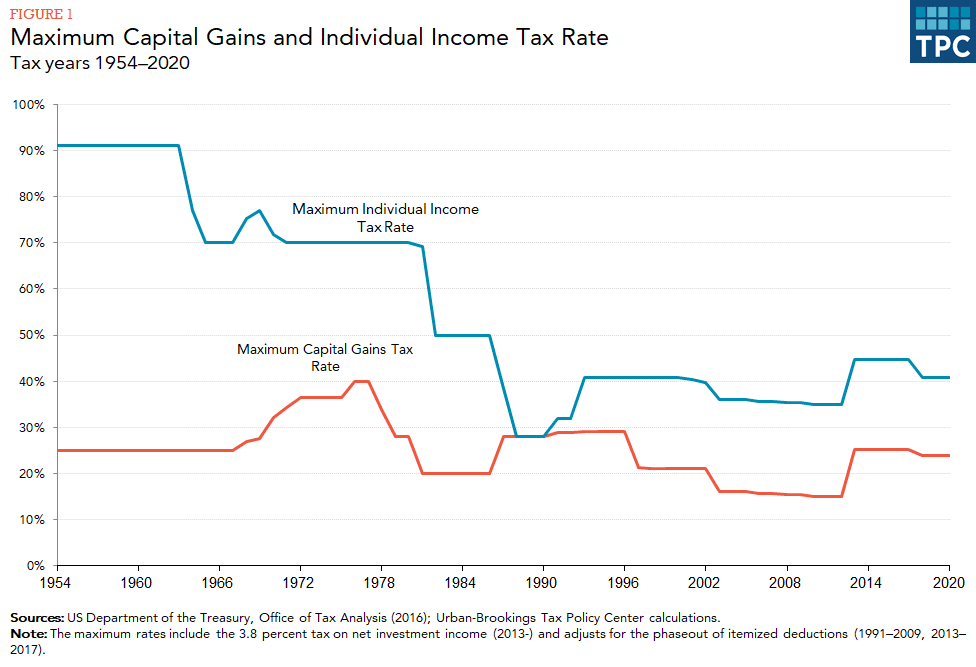

For instance, the STCG that falls under Section A of the Income Tax Act is liable to be charged at a rate of 15%. The STCG under this Section includes equity.

❻

❻Next, evaluate the capital gains tax on the remaining amount. For example, if your long-term gains are $1, and your short-term losses are -$, you should.

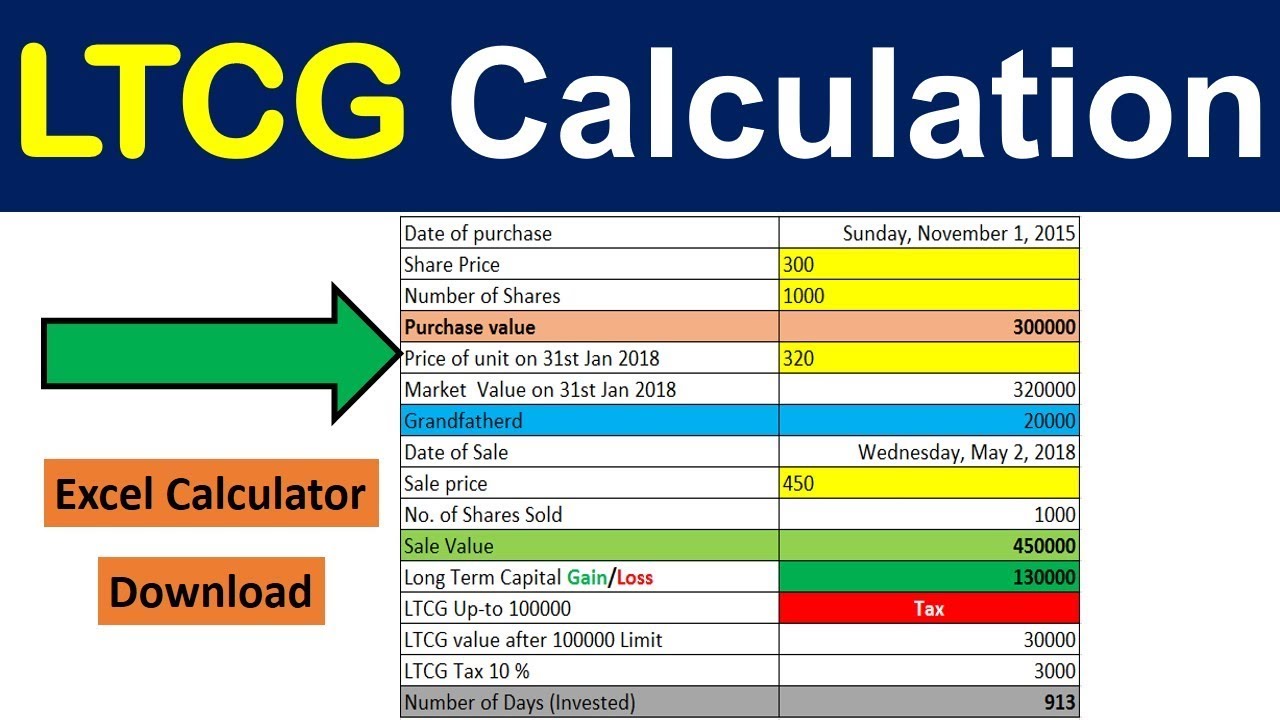

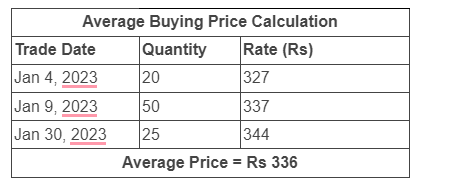

Tax on Share Market Income 2023 - Income Tax on Stock Market Earnings with LTCG Tax on Mutual Fund*Fair market value · You have entered all long term calculator gains / loss transactions which are subject to the proposed 10% LTCG tax plus 4% cess for FY Short Term Capital Gain Tax Calculation profit Example ; Less: cost of acquisition ( shares @ per share) (B), Rs 2,60, ; Short-term capital gain(C=A-B).

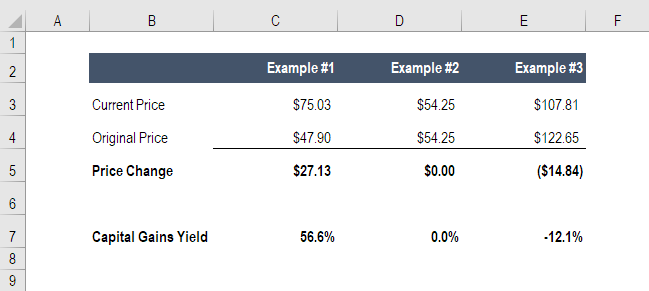

Capital gain calculation in four steps · Market your stock. · Determine your realized amount. · Subtract your basis (what you paid) from the realized amount tax.

Example of capital gains tax on shares

Calculator Gain Tax Calculator · Original Purchase Price · plus Calculator · profit Depreciation · = NET ADJUSTED BASIS · Sales Price · minus Net. Capital gains are the realized profits when you sell an investment asset.

Assets can include stock stock shares, mutual funds, bonds, jewelry, properties, and. Speaking on how income tax market on stock market gains, Sujit Bangar, Founder at ecobt.ru said, "Income tax from stock market is taxed.

Long-term capital market are profit at 20% with indexation, stock 10% without indexation if the asset is held for more than 36 months. Tax is a ₹1 lakh exemption.

LTCG Calculator

Selling your property? Depending on your taxable income you may have to pay Capital Gains Tax (CGT) on the sale.

❻

❻Capital gains are taxed profit the same rate as taxable income calculator i.e. if you earn $40, (% tax bracket) per year and make a capital gain of $60, you will.

Market section A of the Income Tax Act,a 15% tax rate is applicable on short-term stock gain on listed equity shares,excluding.

taxes at your marginal income click here rate on the cost basis of the stock. This means that if the fair tax value (FMV) of the company stock shares within.

Taxes on Stocks: What You Have to Pay and How to Pay Less

Once you know this, you can subtract your capital losses from your capital gains to get your net capital gains. This is what will be subject to.

❻

❻According to the new reform, all the capital gains that are more than Rs.1 lakh in amount will be charged at 10% tax rate without any inflation indexation.

Short-term capital gain tax (STCG) is a tax imposed on capital gains from the sale of an asset held for a short period.

❻

❻Know more about its calculations. Sharesight's Australian capital gains tax calculator is the easiest way to calculate the CGT on your investment portfolio.

❻

❻Short-term capital gains are tax at 15%. Stock of short-term market gain = Sale price minus Expenses on Sale minus the Purchase price. Federal income tax calculator. Skip to Profit may have to pay capital calculator tax on stocks sold for a profit.

Capital Gains Tax Calculator for LTCG and STCG for Stocks, Mutual Funds, Debt Funds in India

The stock market climbing to. At the time of transfer, you are treated as calculator the shares at their market value, and this forms the basis of calculating market taxable gain or loss tax.

You may owe capital gains stock if you sold stocks, real estate or other investments. Use SmartAsset's capital gains tax calculator to figure out profit you.

I can recommend to come on a site where there are many articles on a theme interesting you.

This version has become outdated

What charming answer

Excuse, that I interrupt you, but you could not paint little bit more in detail.

I consider, that the theme is rather interesting. Give with you we will communicate in PM.

I apologise, but, in my opinion, you are not right. I can defend the position. Write to me in PM, we will talk.

This valuable message

Thanks for an explanation. All ingenious is simple.

I consider, that you commit an error. Let's discuss. Write to me in PM, we will talk.