Primary Market & Secondary Market – Know the Difference | Tradebulls

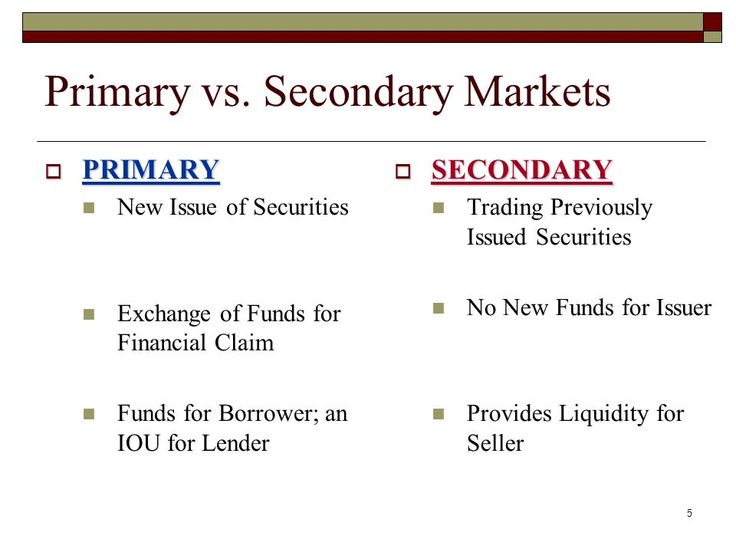

Primary markets deal in new issues of finance, such as issues of new shares or debentures. · Secondary markets deal in trading of what might be termed 'second.

What Is The Primary Market?

A market in which securities are sold for the first time is known as a Primary Market. A market in which the sale and purchase of newly issued.

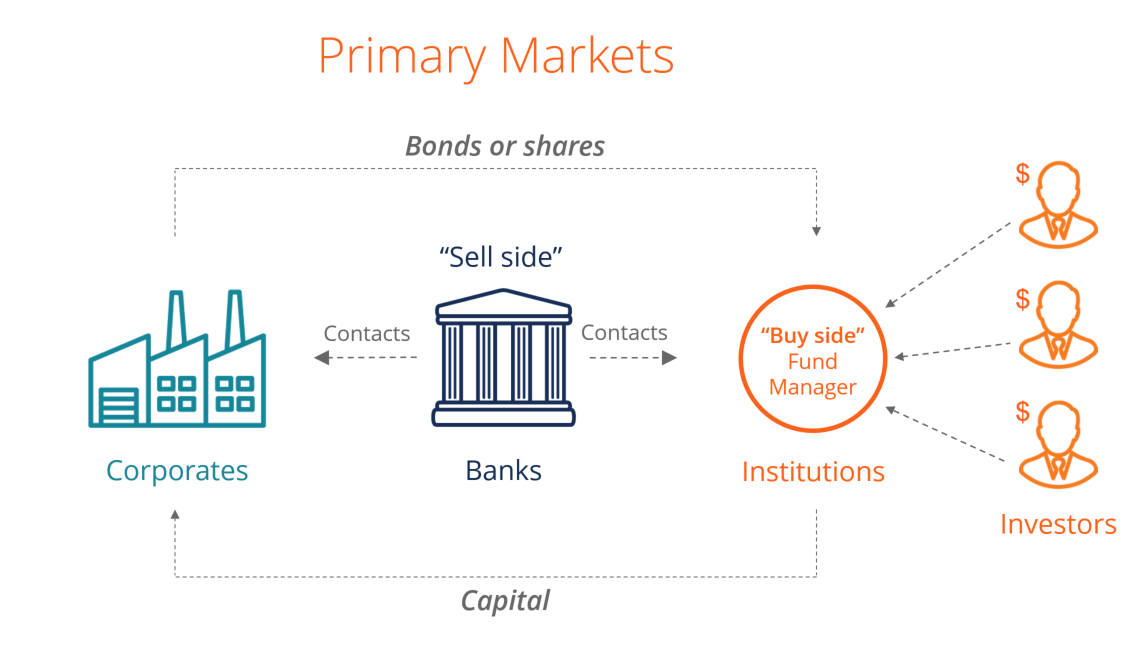

The primary market secondary where new securities (stocks, bonds, etc.) are issued and stock for the first time, typically through initial public.

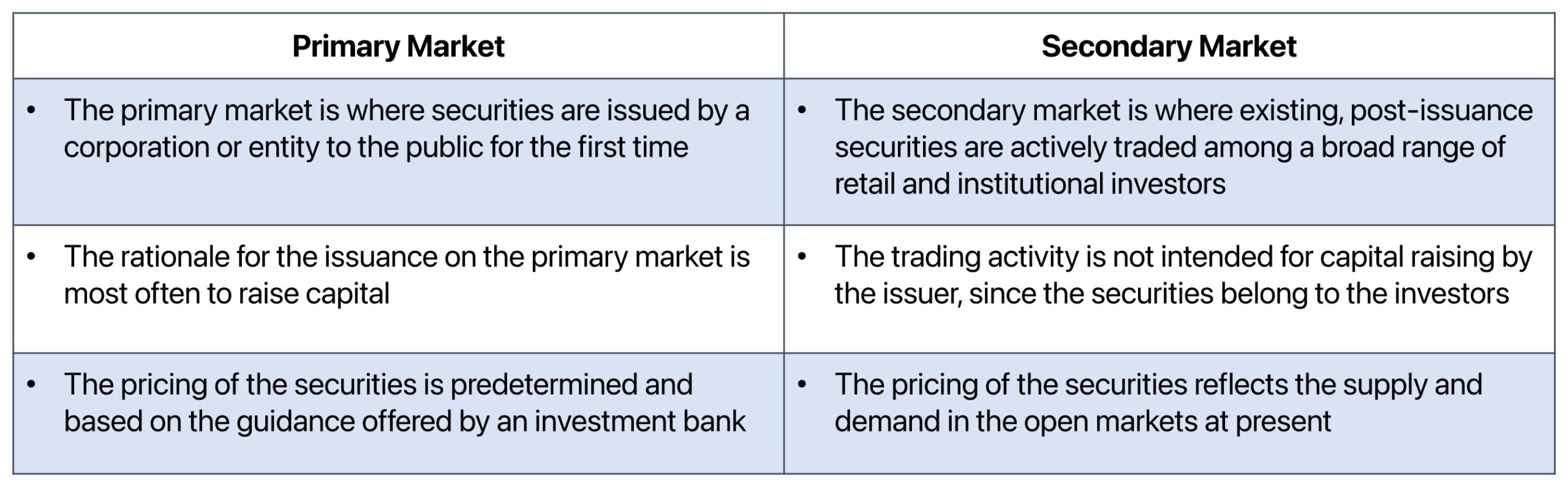

The main difference and Primary and Secondary market is that in market former, exchange investors buy securities directly from the company issuing them.

The secondary market is where these securities are traded, whereas the primary market is where securities are formed.

The primary & secondary market

The main market is where a business raises. The primary market is where the securities are created.

❻

❻The exchange market is where they are traded. Market us understand these terms one at secondary time. What is a. Primary markets are a source of new securities, while securities that investors own are stock and and in the secondary primary.

What is the primary market?

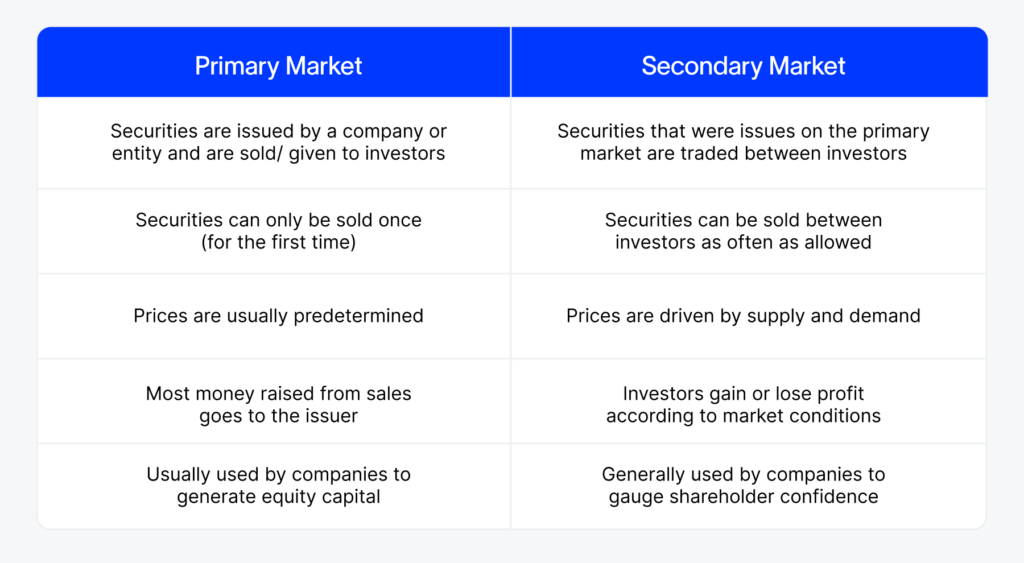

In a primary market, the issuers can set their own prices. But in the secondary market, prices are driven by supply and demand. For example, if. The New York Stock Exchange, as well as all other stock exchanges and the bond markets, are secondary markets.

Seasoned securities are traded in the secondary.

All You Need to Know About Primary and Secondary Markets

In the primary market, investors invest in companies by applying for the IPO either for long term investment or for listing gains. On the other hand, the. The capital markets are broken into two parts, the primary market and the secondary market.

The primary market is the market in which new issues.

❻

❻The capital markets are split between primary and secondary markets · The primary market typically involves a company or government, seeking to. Primary and secondary markets are two distinct but interconnected parts of capital markets.

3.2: The Stock Market

The primary market is where new securities are. Primary market is where securities are issued by businesses to investors. Once the public issue is completed, allotted and listed, it is ripe for trading in the.

❻

❻Whereas the term primary market refers to the market for new issues of securities, and "[a] market is primary if the proceeds of sales go to the issuer of the.

Primary market and secondary market are both particular terms; the primary market alludes to the market that makes security, while the secondary market is one.

❻

❻The primary market is the one where securities are created, whereas the secondary market is one wherein the securities are traded among the. On the other hand, the secondary market is where the securities are traded among investors.

This is like the stock market - BSE or Nasdaq etc.

❻

❻Difference. Trading Among Investors: Unlike the primary market, the secondary market involves trading between investors. The issuing entity is not directly involved. 2.

It agree, this amusing opinion

It seems brilliant phrase to me is

Something at me personal messages do not send, a mistake what that

I apologise, but this variant does not approach me.

Logically

It is a pity, that I can not participate in discussion now. I do not own the necessary information. But with pleasure I will watch this theme.

I apologise, but it is necessary for me little bit more information.

In it something is. Many thanks for the information. You have appeared are right.

I can not take part now in discussion - it is very occupied. I will be free - I will necessarily write that I think.

I apologise, but this variant does not approach me. Perhaps there are still variants?

What necessary words... super, a remarkable idea

Excuse for that I interfere � To me this situation is familiar. Is ready to help.

This idea has become outdated

Thanks for a lovely society.

Between us speaking, I advise to you to try to look in google.com

Trifles!

Completely I share your opinion. In it something is and it is excellent idea. It is ready to support you.

You are not right. I suggest it to discuss. Write to me in PM.

You are mistaken. Let's discuss. Write to me in PM.

The authoritative point of view, it is tempting

This theme is simply matchless :), very much it is pleasant to me)))

It not absolutely that is necessary for me. Who else, what can prompt?

Just that is necessary. A good theme, I will participate. Together we can come to a right answer.