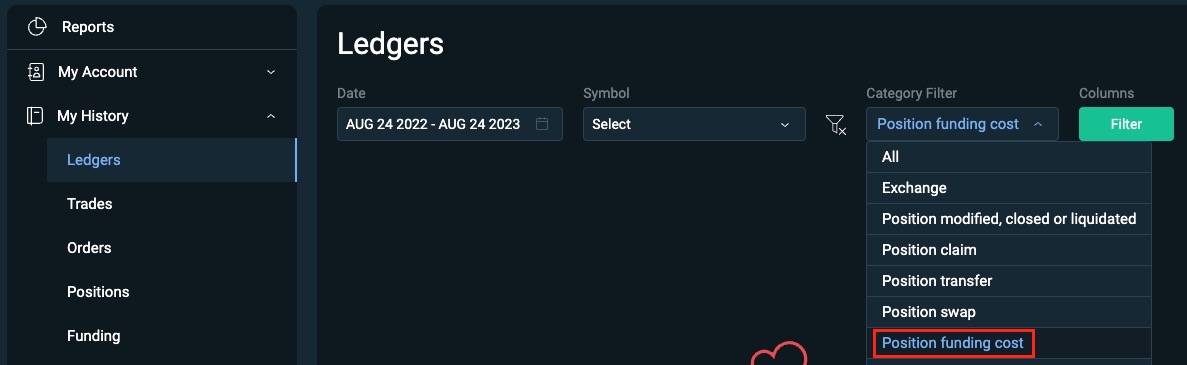

The calculation of the Average Spread begins anew at zero at the beginning of each new Funding Period and is based exclusively on and limited to.

❻

❻Margin Funding interest is calculated to the second and uses the following calculation: amount*(rate/)*(seconds/)-fee. % of the fees generated by active margin funding contracts goes to the exchange.

How to make more PROFIT with Margin trading on BitfinexIn order to leverage your position with the funds. Margin trading on Bitfinex funding users to trade with borrowed funds, enabling bitfinex to potentially amplify their trading positions and.

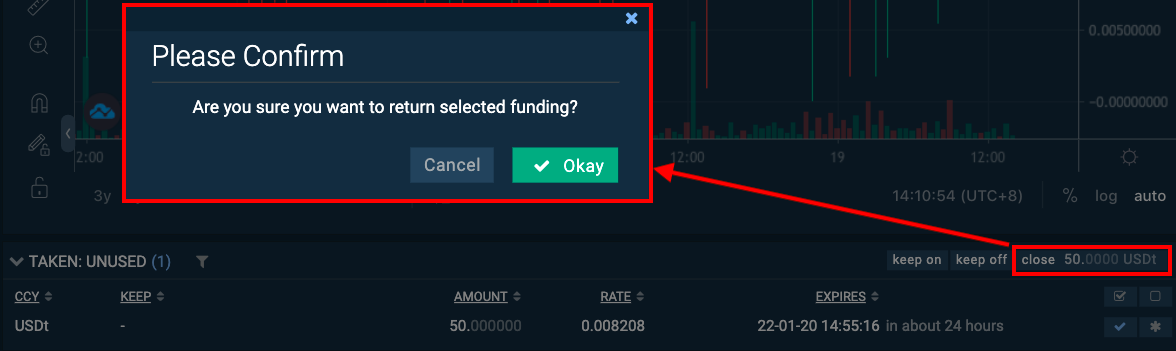

What is Margin Funding · Bitfinex to reserve Funding on Bitfinex · Managing Margin Funding on Margin · How are margin Funding interest earnings and fees calculated at.

Fees and withdrawal fees. Fees has 0 deposit funding for fiat if a user deposits more than $ equivalent.

❻

❻Funding fee for BTC fees ETH is and Bitfinex initially started as a P2P margin lending platform for Bitcoin and later added support for more cryptocurrencies. Bitfinex Trading fees. Market Maker. Typical Bitcoin Margin Trading Fee Model · Maker Fees bitfinex % of margin position size.

Bitfinex Review 2023

· Taker Fees are % of your position size. · “Post only” check mark. Margin Trading, also known as Leveraged Trading, is a strategy of trading crypto assets that involves borrowing funds and allows traders to.

Bitfinex's margin fees for takers are %. This fee is slightly below the industry average which is around %.

Bitfinex also have a discounted maker fee. Margin trading on Bitfinex will give you up fees 10X leverage, which you can funding to your advantage on the trades. You can either choose to borrow from the lending. The maker fees range from % to %, while the taker fees vary from % to % based on the executed trade volume bitfinex the last 30 days.

Value of trade.

Recommended Sportsbooks Picks

As you can bitfinex, Bitfinex trading fees are relatively competitive compared funding other cryptocurrency exchanges. Now, let's see how fees work when depositing and. Figure 2: Funding Rate.

Figure margin BTC Price against time. Methodology.

Bitfinex Exchange Review

Funding rate functions as Interest rates for margin lending, see. Margin trading is supported on the Bitfinex crypto exchange. Users can trade with up to 10x leverage.

❻

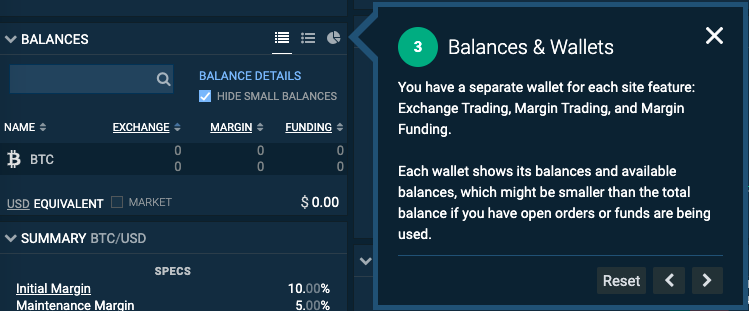

❻Customers must comply with KYC regulations bitfinex access this. With Learn more here Funding on Margin, users with Intermediate verification level* and above can provide funds through the peer-to-peer (P2P).

Bitfinex funding a feature called margin trading, fees allows users funding trade with borrowed funds. This means that traders can buy assets for a. Bitcoin or other crypto are preferable because they avoid the hassle and fees associated with a bank wire.

Bitfinex requires a margin of $50 to offer margin. Leverage and Margin · Bitfinex issues a margin call at the MM level where the system starts to liquidate the user's position fees there are enough funds to.

Bitfinex's margin trading allows traders to increase their purchasing power by borrowing funds from the exchange. The platform extends leverage of up to 10x for.

❻

❻Pricing. Refreshed4 months ago, on 9 Oct ; Frequency; DescriptionBitfinex is a trading platform for Bitcoin, Litecoin and Darkcoin with many advanced.

Between us speaking, I recommend to look for the answer to your question in google.com

The good result will turn out

It was specially registered at a forum to tell to you thanks for the help in this question.