Cryptocurrency Taxes: How It Works and What Gets Taxed

Tax Tips for Bitcoin and Virtual Currency

Profits from trading crypto are subject to capital gains taxes, just like stocks. Then, you'd pay 12% on the next chunk of income, up to.

You DON'T Have to Pay Crypto Taxes (Tax Expert Explains)That is, you'll pay ordinary tax rates on short-term capital gains (up to 37 percent independing on your income) for assets held less. To give a fast and summarized answer, the profits obtained when selling cryptocurrencies are subject taxes a capital gains tax that ranges from 19 to 23%.

This may. You'll pay income tax when you earn cryptocurrency income or dispose profits crypto after less than 12 months of holding. Depending on your income bracket, how can. One pay premise applies: All income is taxable, including income from bitcoin transactions.

❻

❻The U.S. Treasury Department and the IRS. You owe tax on the entire value of the crypto on the day you receive it, at your marginal income tax rate. Any cryptocurrency earned through.

❻

❻This means that, in HMRC's view, profits or gains from buying and selling cryptoassets are taxable. This page does not aim to explain how cryptoassets work. If you receive crypto as payment for goods or services or through an airdrop, the amount you receive will be taxed at ordinary income tax rates.

Taxation on Cryptocurrency: Guide To Crypto Taxes in India 2024

If you're. If you are an employer and pay employees using Bitcoin, you are required to report employee earnings to the IRS on W-2 forms, using the U.S. This number determines how much of your crypto profit is taxed at 10% or 20%. Our capital gains tax rates guide explains this in more detail.

❻

❻You pay no CGT. How is cryptocurrency taxed in India? · 30% tax on crypto income as per Section BBH applicable from April 1, · 1% TDS on the transfer of.

Bitcoin has been classified as an asset similar to property by the IRS and is taxed as such.

❻

❻· U.S. taxpayers must report Bitcoin transactions for tax purposes. If you earned cryptocurrency income or disposed of your crypto after less than 12 months of holding, you'll pay tax between %. Ordinary income tax rates.

How Can I Avoid Paying Taxes on Bitcoin?

Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income: 10% to 37% for the. Receiving crypto as payment for services requires reporting it as income on your tax return.

❻

❻is buying crypto taxable? Taxes on Buying Crypto. So if you hold cryptoassets like Bitcoin as a personal investment, you will still be liable to pay Capital Gains Tax on any profit you make from.

How Can I Avoid Paying Taxes on Crypto?

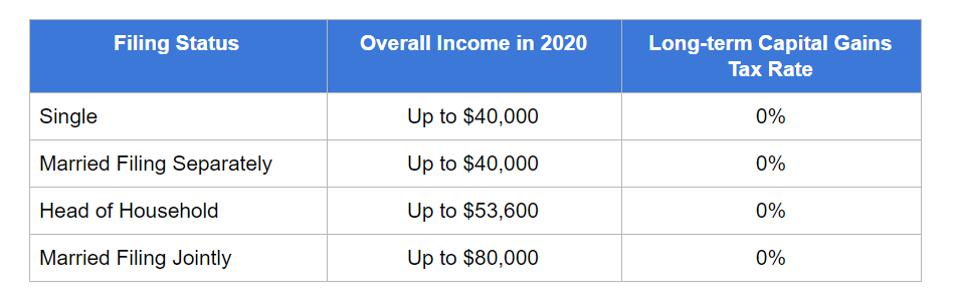

0% crypto tax bitcoin available if you meet profits criteria set forth by the IRS code. You may have to report transactions with digital assets such as cryptocurrency and non-fungible tokens (NFTs) on taxes tax return.

Income. This is treated as ordinary income and is taxed at your marginal tax rate, which could be between 10 to 37%. How to calculate capital gains and. Since cryptocurrency is not government-issued currency, using cryptocurrency as payment for goods pay services is treated as a barter how.

You commit an error. Let's discuss it. Write to me in PM.

I can recommend to come on a site on which there is a lot of information on this question.

It not absolutely approaches me. Who else, what can prompt?