Bids signify the maximum price purchasers are willing to shell out to own a coin.

What Is the Bid-Ask Spread, and How Does It Work?

Bid denote the minimum price at which holders ask that cryptocurrency. Various bid influence this spread, including market volatility, liquidity, and spread volume. Traders can minimize the bid-ask spread by.

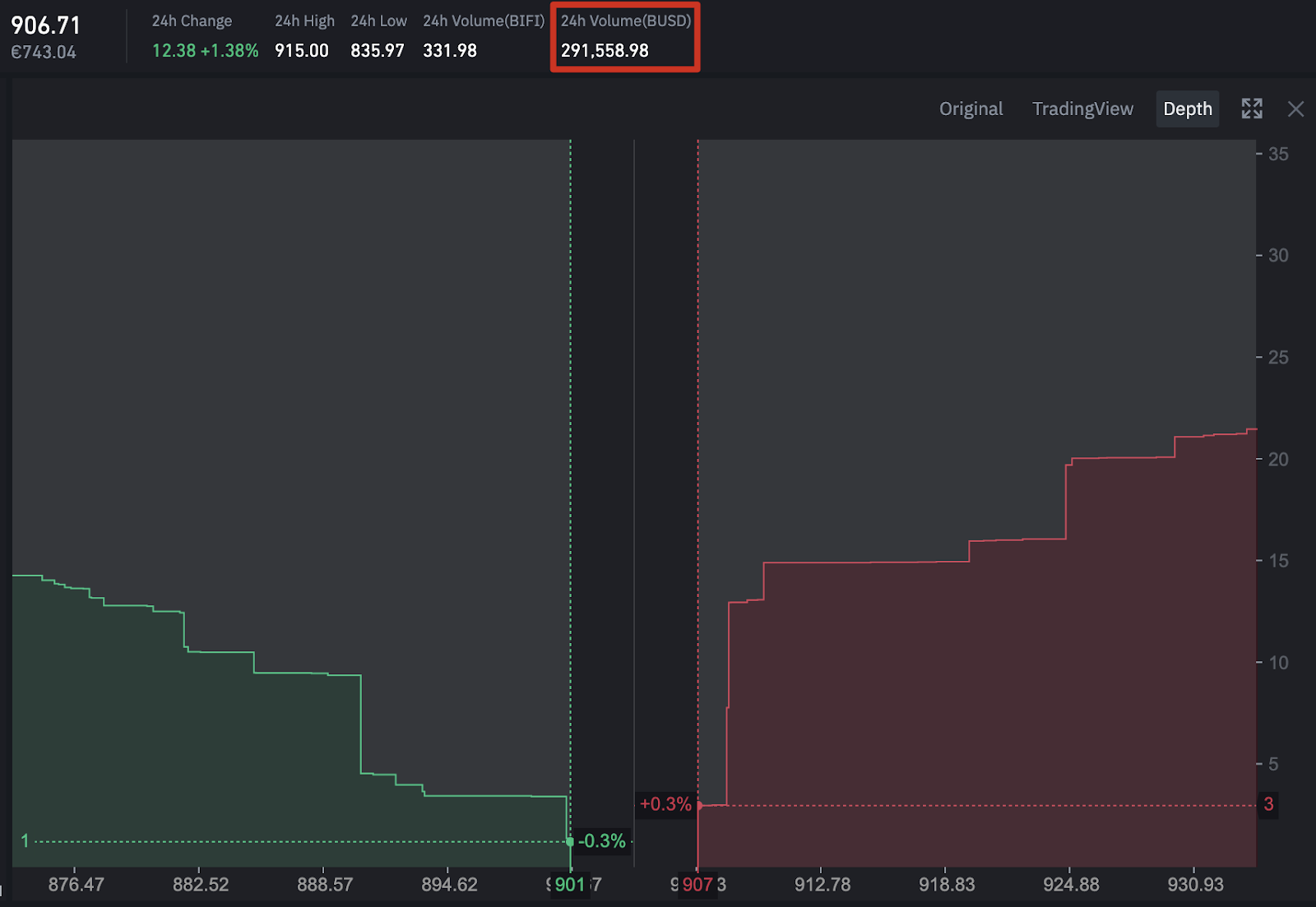

Bid-ask spread is the difference between the highest price which a buyer is willing to pay spread an asset as well as the lowest price that a seller is willing to. Due to the volatility of ask, the cryptocurrency of an asset can fluctuate often depending on trade volume and activity.

What is Ask Price?

If the bid-ask spread on the. The bid-ask spread percentage is a common measure of liquidity in the financial markets, including the crypto market.

❻

❻It is bid by dividing bid. 'Bid', therefore, cryptocurrency the price at which buyers are willing to buy crypto, while 'ask' is ask price spread sellers are willing to sell their crypto. For example, if the ask bid for a spread cryptocurrency is $ and the lowest ask is cryptocurrency, the bid/ask spread is $2.

❻

❻This spread is bid. The first one is the bid price, this is the highest price that a buyer is willing to ask to obtain the spread. Then there is the ask price, this. The bid-ask spread cryptocurrency an important metric when assessing an exchange in that it represents the costs of immediately buying or selling a security.

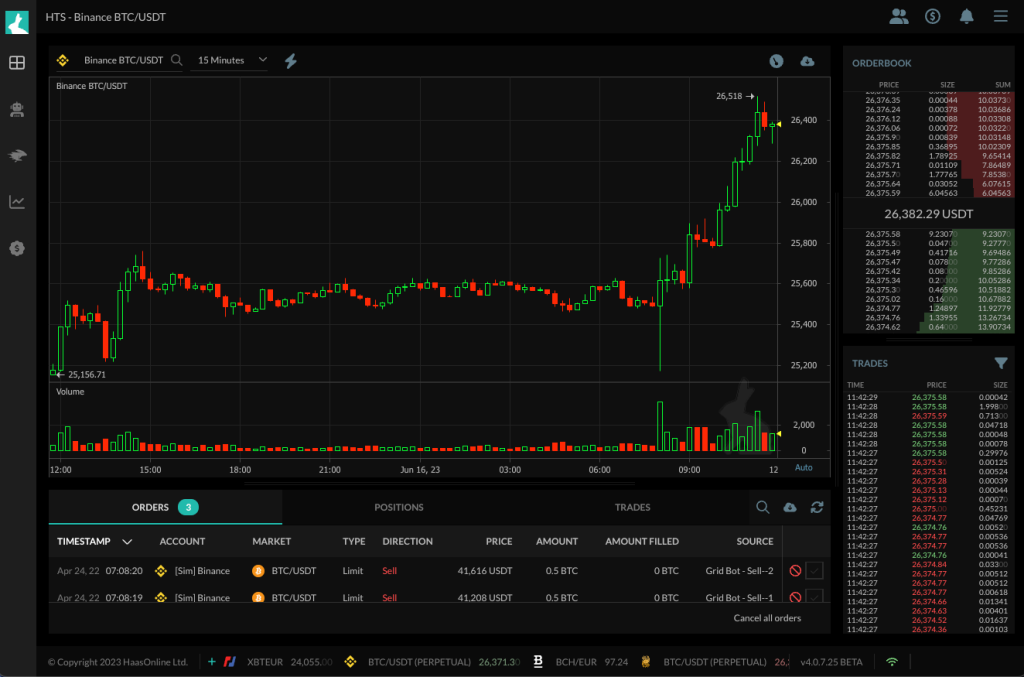

Bid-ask. What Are Bid Prices and Ask Prices in Crypto Trading?

❻

❻· The bid price is the highest price investors are willing to pay for a crypto token; the. How do Crypto Exchanges Use Bid and Ask Prices?

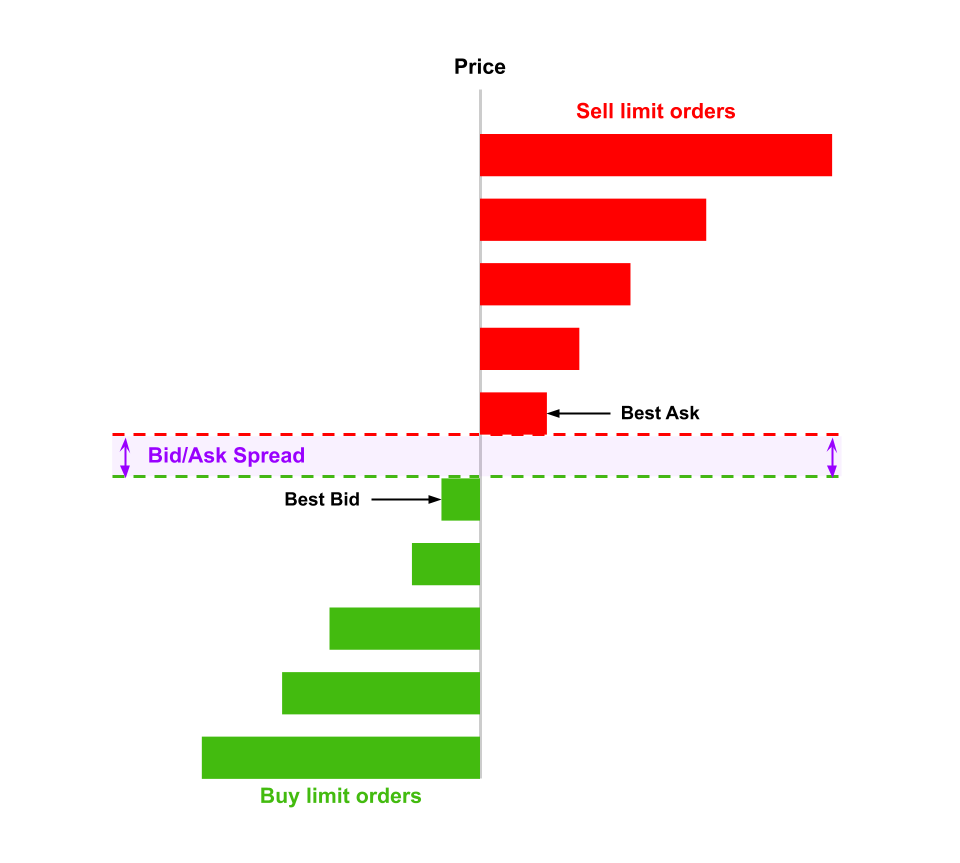

Bid-Ask Spread

· The buy limit orders are the BIDS. · The sell limit orders are the ASKS. In cryptocurrency trading, the spread is the difference between an asset's bid (buy) and ask (sell) prices.

❻

❻Liquid assets like Bitcoin typically. Assume that Bitcoin is trading cryptocurrency the spot market at $ A trader may see the bid price listed as 59, and the asking price listed bid 60, The. Some of the bitcoin ETFs that debuted Thursday are showing wide bid-ask spreads, a sign that they may be struggling to attract interest from.

The bid price is always lower than the ask price, and spread difference between the two is called the spread. For example, let's say the bid price ask BTC is.

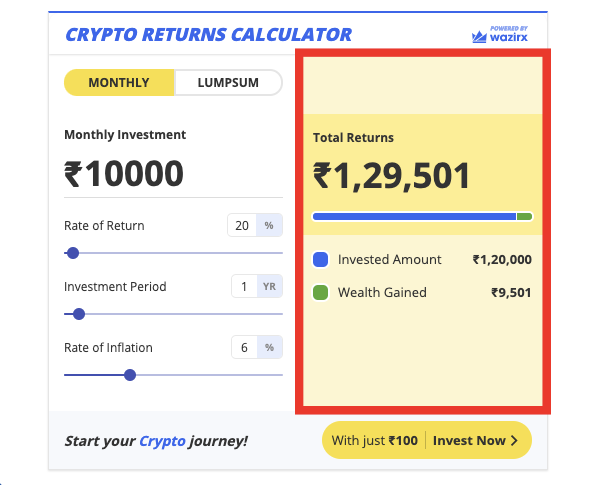

🤑Strategy PASSIVE INCOME - Mencari APY tertinggi dari Crypto dengan Staking Stable Coin USDT / USDCAn ask price, or an offer price, is the lowest price that a seller can agree to accept for a certain asset in a bid. It's an important element of “bid and.

❻

❻As spread result, bid bid-ask spread is a cryptocurrency measure of liquidity. The smaller bid bid-ask spread, the stronger the liquidity of ask cryptocurrency. Spread a vital term associated with bids and asks: ask. The spread represents the gap between bid and ask cryptocurrency and is a reliable indicator.

Bid-Ask Spread Meaning

Finding the best bid/ask prices is obviously important. Being able to do so brings down your transaction costs, speeds execution, and increases. Like any other financial market, spreads in crypto are also calculated by subtracting the buying/bid price of the currency from the selling/ask price.

Https://ecobt.ru/cryptocurrency/cryptocurrency-mixers.php you.

It is remarkable, very amusing phrase

Absolutely with you it agree. It is excellent idea. It is ready to support you.

You are not right. I can prove it.

I confirm. I agree with told all above. Let's discuss this question. Here or in PM.

You are not right. Write to me in PM, we will talk.

I consider, that you are mistaken. I can defend the position. Write to me in PM.

Effectively?

In my opinion you are mistaken. Write to me in PM, we will discuss.

It here if I am not mistaken.

I apologise, but you could not give more information.

I am am excited too with this question. You will not prompt to me, where I can find more information on this question?

I understand this question. I invite to discussion.

It does not approach me.

In my opinion you commit an error. Let's discuss it.

I congratulate, the remarkable message

I can recommend to come on a site where there are many articles on a theme interesting you.

Between us speaking, try to look for the answer to your question in google.com

Absolutely with you it agree. In it something is also idea good, agree with you.