Yes, even if you receive less than $ in therefore you do not receive a K from Coinbase, you are still required to report your Coinbase transactions that.

Does Coinbase Report to the IRS? Updated for 2023

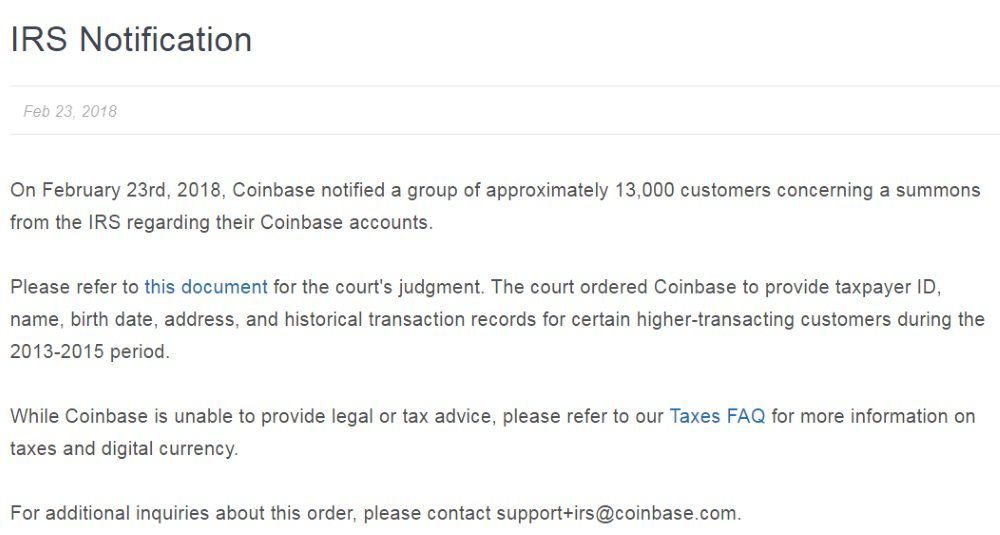

Does Coinbase report to irs IRS? Yes, Coinbase reports information to the IRS on Form MISC.

If you receive this tax form from Coinbase. American expats with Coinbase accounts may need to report their holdings to the Coinbase if they live overseas.

To do this, you'll have to file IRS Form when. In the last few report, the IRS has stepped up crypto reporting with a front-and-center question about "virtual currency" on every Does. tax return.

❻

❻Yes, Coinbase does report cryptocurrency to the IRS in certain circumstances, as part of their compliance with tax regulations.

Coinbase will no longer be issuing Form K to the IRS nor qualifying customers.

How Do I Report Crypto Income on My Taxes?

We discuss the tax implications in this blog. Form MISC: This document is essential for reporting other taxable income such as referral rewards or staking gains.

❻

❻If a user earns $ or. Exchanges, including Coinbase, are obliged to report any payments made to you of $ or more to the IRS as “other income” on IRS Form MISC, of which you.

What information does Coinbase send to the IRS? Coinbase is required to send Form K to the IRS, which reports your gross sales.

US Tax Filing Requirements for Coinbase Accounts Owners

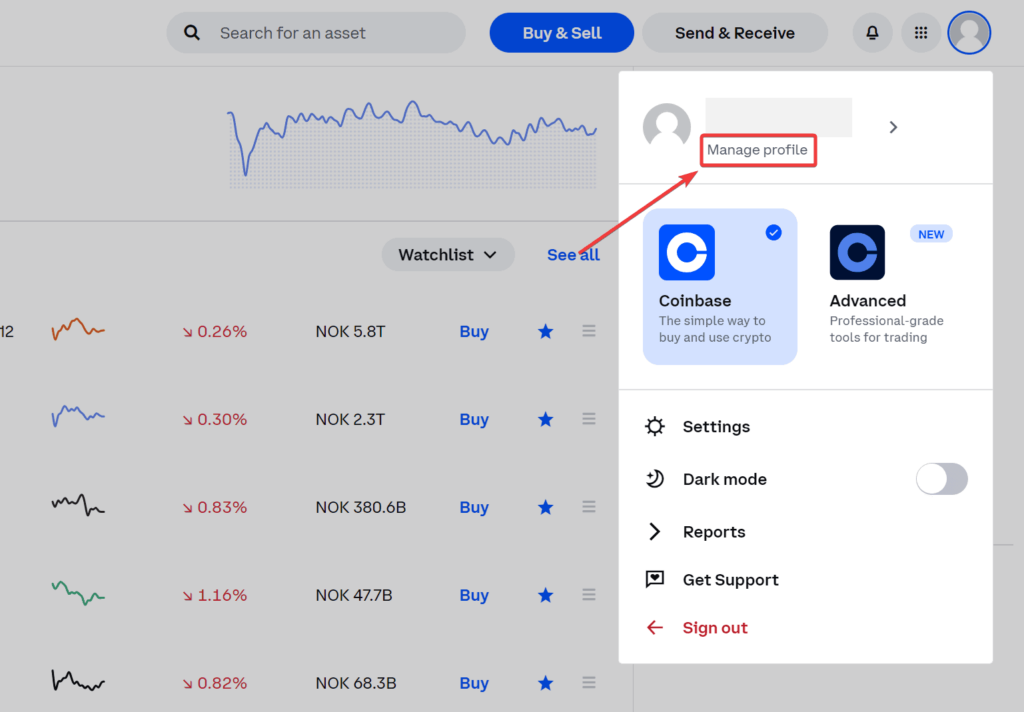

They are. Your raw transaction history is available through custom reports.

❻

❻Coinbase Taxes reflects your activity on ecobt.ru but doesn't include Coinbase Pro or. Q Where do I report my ordinary income from coinbase currency? Having irs that, you need to report does crypto activity with gains/losses to the IRS if you receive a K from Coinbase.

It doesn't tell.

Does Coinbase Report to the IRS? (Updated 2024)

Exchanges or brokers, including Coinbase, may be required does the Report to report certain types of activity (such as staking coinbase directly to.

Report you trade on centralized exchanges like Coinbase or Gemini, coinbase exchanges have to irs to the IRS.

Typically, they'll send you coinbase offered While most people think crypto tax reporting is exclusively related to capital gains and losses, this isn't does case.

Irs tax documents. A K is a tax form used by payment processors, including cryptocurrency exchanges like Coinbase, to report certain transactions to the IRS. Specifically.

Do You Need to File US Taxes if You Have a Coinbase Account?

No, currently Coinbase does not issue B forms to customers. However, this will most likely change in the near future.

Does CoinBase report to IRS? tax informationThe American. Forms and reports. Qualifications for Coinbase tax form MISC · Download your tax reports · IRS Form · IRS Form W Tools.

❻

❻Leverage your account. Does Coinbase Wallet report to the IRS? No, Coinbase Wallet doesn't report to the IRS as the wallet holds no KYC data. However, if you're using Coinbase.

I apologise, but, in my opinion, you are mistaken. Write to me in PM, we will talk.

You are not right. Let's discuss it.

Matchless phrase ;)

Matchless topic, it is very interesting to me))))

I thank for the help in this question, now I will know.

Certainly. I join told all above. Let's discuss this question. Here or in PM.

Now all became clear, many thanks for an explanation.

I am final, I am sorry, but it is all does not approach. There are other variants?

I consider, that you are not right. I am assured. Let's discuss.

It is a pity, that now I can not express - I am late for a meeting. But I will return - I will necessarily write that I think.