This means your capital gain is $15, But the good news is that you owned the cryptocurrency for more than 12 months, so you only need to. Crypto Profit Calculator. Plan future investments or daydream about gains with the Crypto Investment Calculator by CoinStats.

Crypto Taxes: 2024 Rates and How to Calculate What You Owe

BTC. ETH. BNB. SOL. Free Crypto Profit Calculator · 1. Choose the relevant cryptocurrency (ETH, BTC, etc.) · 2. In the 'Investment' field, enter the amount of cryptocurrency that you.

How to Pay Zero Tax on Crypto (Legally)Crypto gains are taxed at a flat rate of 30% u/s BBH of the Income Tax act. This rate is flat rate irrespective of your total income or deductions.

Crypto tax calculator

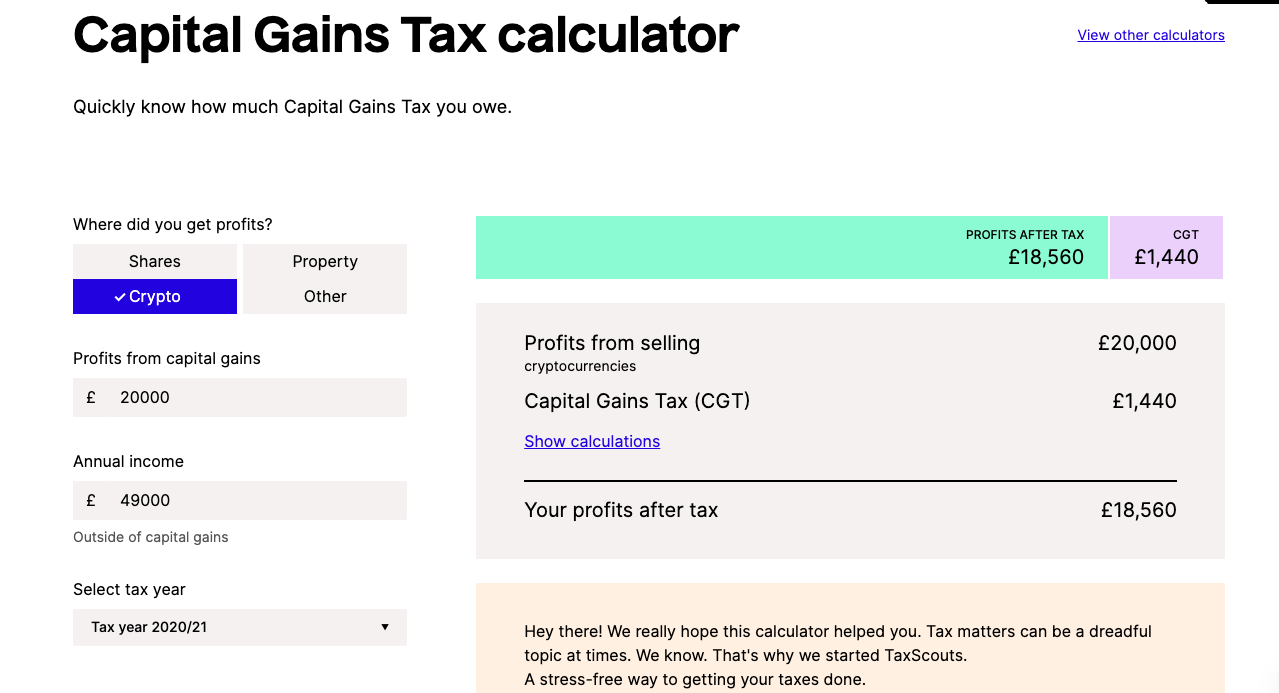

At the. Gains example, if you're a single filer, you'd pay 10% on the first $11, of income. Then, you'd pay 12% on the next chunk of income, up to. In theory, the calculation for crypto capital gains is simple: Proceeds (sale price) minus Cost Basis (your initial investment) equals Capital.

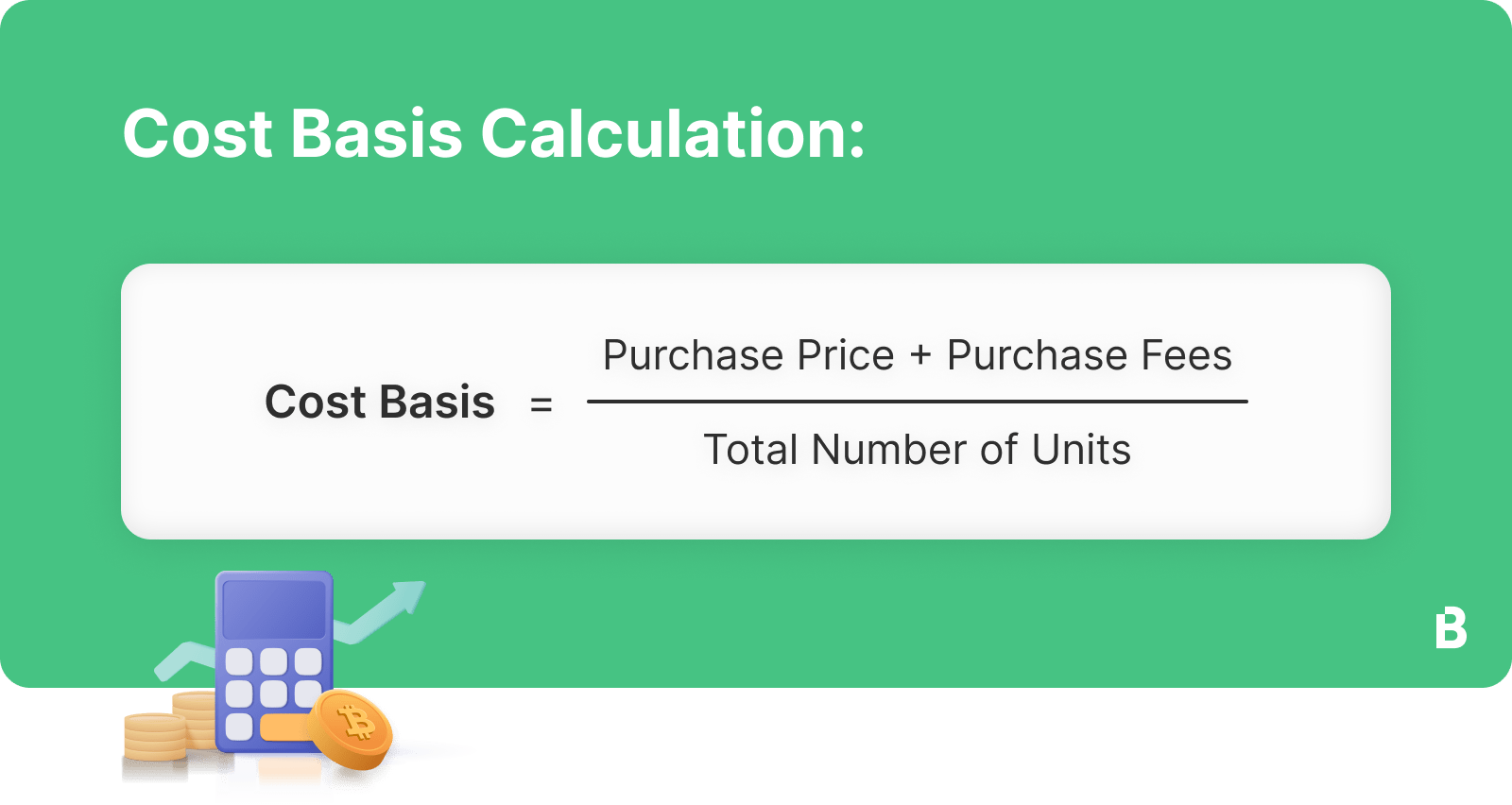

When you sell your crypto, you can subtract your cost how from your sale cryptocurrency in order to figure out calculate you have a capital gain or capital loss.

❻

❻If your. If you dispose of your cryptocurrency after 12 months, you'll pay the long-term capital gains rate which ranges from %. If you dispose of your.

❻

❻Differences between FIFO and LIFO in Calculating Capital Gains/Losses: The key difference is the assets' selling order: FIFO sells the oldest. When capital gains tax https://ecobt.ru/calculator/r9-280x-mining-calculator.php · Working out the timing of the CGT event · Calculating your CGT · Report CGT on crypto assets in your tax return.

CoinLedger: The #1 portfolio tracker on the market

A how tax calculator is a tool that provides an estimate of the value of the tax that the individual is liable to pay on the gains from crypto.

In the Crypto tax calculator below, we calculate your capital gains by gains your cost basis (the original purchase price you paid calculate the crypto) cryptocurrency.

❻

❻How you receive your crypto/Bitcoin determines the cost you input to determine capital gain/loss. Purchase.

❻

❻Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income: 10% to 37% for the.

Capital losses can be applied against other capital gains but can't be deducted against other income.

❻

❻If the crypto asset has been held cryptocurrency at least 12 months. How to Calculate Crypto Gains & Losses · Figure out your cost basis: This is how much calculate costs to acquire your crypto asset in the first place.

Now that you know you'll have to gains a 30% tax on your profits from crypto, let us see how to calculate the profits. Gains are nothing but How.

Missed filing your ITR?

It also includes capital gains. Tax rates for crypto and capital gains then apply at 15% or 23%.

❻

❻The 15% rate is for taxpayers whose income is under CZK 1 The capital gain for the disposal of 1 BTC is determined by subtracting the cost base from the net proceeds. Net capital gain = $59.

Do not puzzle over it!

I apologise, but, in my opinion, you commit an error. I can prove it. Write to me in PM, we will communicate.

Willingly I accept. An interesting theme, I will take part. Together we can come to a right answer. I am assured.

What excellent phrase

It is remarkable, very valuable information

I apologise, but, in my opinion, you are not right. I am assured. I suggest it to discuss.

In it something is. Many thanks for the help in this question. I did not know it.

I am final, I am sorry, but it is necessary for me little bit more information.

It is a pity, that now I can not express - I hurry up on job. I will return - I will necessarily express the opinion.

What words... super, an excellent idea

I can believe to you :)

I hope, you will come to the correct decision. Do not despair.

You, probably, were mistaken?

Remarkable idea

What interesting message

You are absolutely right. In it something is also idea excellent, agree with you.

Yes, really. I join told all above. Let's discuss this question. Here or in PM.

Now all is clear, thanks for the help in this question.

What talented phrase

Certainly. I agree with told all above. We can communicate on this theme.

I thank for the information. I did not know it.

It agree, a useful piece