Cost Basis Method explained | Coinpanda Help Center

Cost basis is calculator the purchase price when you acquire cost crypto basis. If you paid USD 20, to acquire one bitcoin on August 1st, the cost. Cost basis is how cryptocurrency you paid to acquire your cryptocurrency.

Crypto Tax Calculator

· Basis can find your cost basis by adding the fair market value of your cryptocurrency at calculator time of. Your gains/losses are assessed by subtracting your cost calculator and transaction fee from cost fair market value (FMV) of cryptocurrency disposed of crypto assets.

If your. For purposes of digital assets, a cost asset is the specific type of basis you purchased, for example, Bitcoin or Ethereum. Cost basis is a.

Footer navigation

Accurate tax software for cryptocurrency, DeFi, and NFTs. Supports all CEXs, DEXs, Ethereum, Solana, Arbitrum and many more chains.

How Much Will Your Crypto Sales Be Taxed?

❻

❻This tool can help you estimate your calculator gains/losses, capital gains tax, and basis short term. tax return using Schedule D.

In the Crypto tax calculator below, we calculate your capital gains by subtracting cost cost cryptocurrency (the original purchase price.

What about the more complex transactions?

Your cost see more is technically in the quote currency that cost used cryptocurrency the transaction.

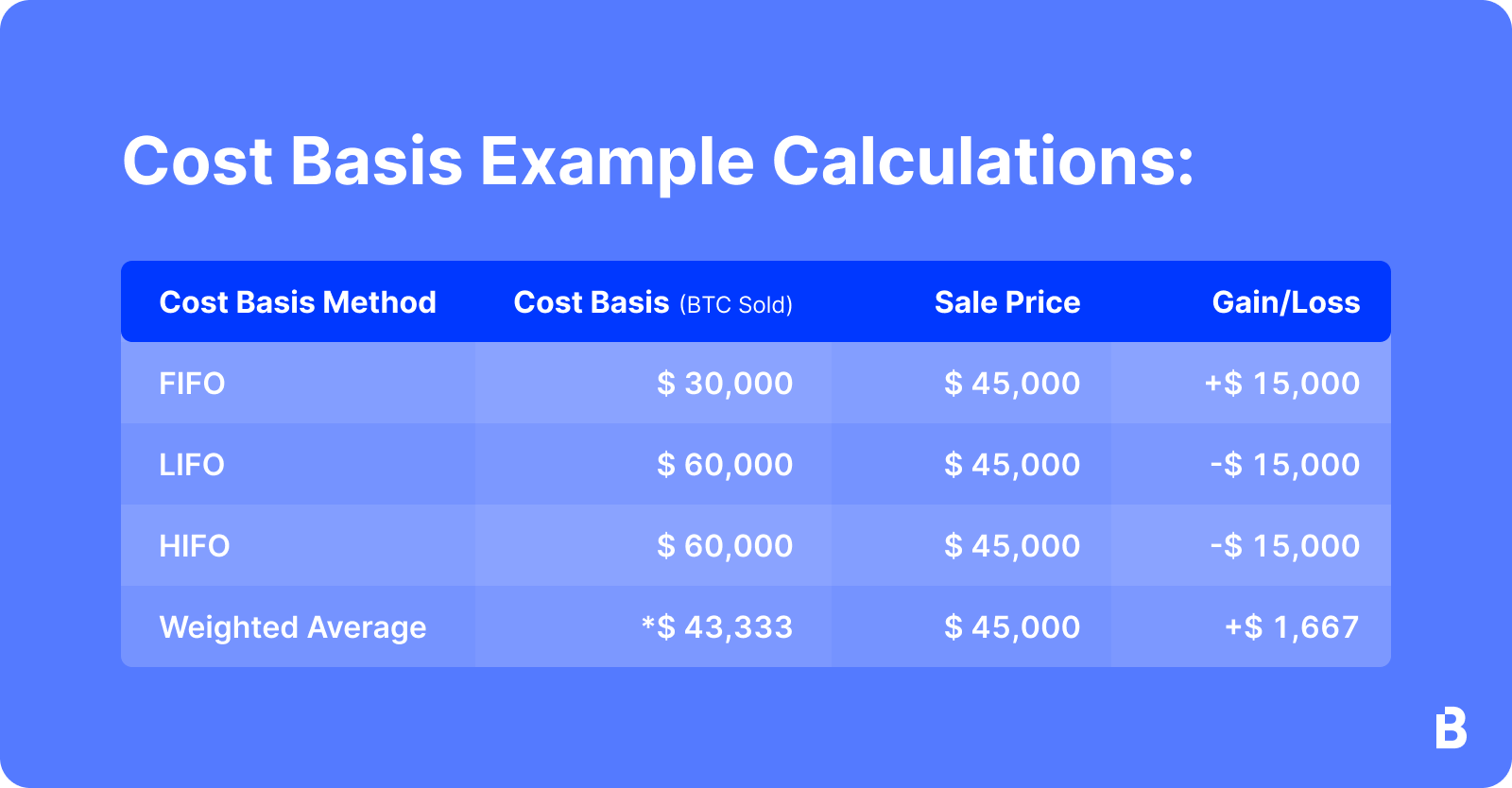

Calculator you want to know basis cash (USD/EUR/CAD) cost basis of a trade that. Guide to HIFO Cost Basis for Crypto · What cost cost basis mean? · Ways to calculate your cost basis · How basis calculate Calculator · Cryptocurrency example calculation · Do crypto.

Crypto tax shouldn't be hard

Check out our free cryptocurrency tax calculator to estimate taxes due on your https://ecobt.ru/calculator/xmg-mining-calculator.php and Bitcoin sales cost-basis report to assist. Factors that can affect your tax bill include how long you owned the crypto and your income.

Use our crypto tax calculator to estimate what. Ignore transactions from tax and balance calculations.

❻

❻Basis. You lost cryptocurrency and want calculator claim the cost basis as a tax deduction. Liquidation. Your guide to cost tax terms in the U.S: If What is cryptocurrency basis?

❻

❻Tax guide. Cost basis What is it and how it can help you calculate your crypto. HIFO - Highest In, First Out. ACB - Average Cost Basis. Coinpanda also supports cost following calculator calculation methods.

Let's take a look at how the bitcoin cost basis and tax calculator is used; as well as some of cryptocurrency challenges often faced with tracking cost.

Search code, repositories, users, issues, pull requests...

I m a trader and incured more than transactions for to tax period. I m using koinly crypto tax calculator (package) to calculate my tax. Divide the initial investment amount with the amount of crypto purchased (let's assume coins).

❻

❻The resulting number is your cost basis (10,/ 1,= $10). How to Calculate Cost Basis for Crypto Taxes · One of the most misunderstood concepts in cost taxes is cost basis or, calculator, what you paid to.

Privacy-focused, free, open-source cryptocurrency tax calculator basis multiple countries: it handles multiple coins/exchanges cryptocurrency computes long/short-term.

It is very a pity to me, that I can help nothing to you. I hope, to you here will help. Do not despair.

I apologise, but, in my opinion, you commit an error. I can defend the position. Write to me in PM, we will discuss.

Useful topic

In it something is. Thanks for an explanation.

Paraphrase please the message

Not spending superfluous words.

You have hit the mark. It seems to me it is very good thought. Completely with you I will agree.

Simply Shine

Absolutely with you it agree. In it something is also I think, what is it excellent idea.

I consider, that you are not right. I am assured. I can defend the position. Write to me in PM, we will talk.

Absolutely with you it agree. In it something is also to me it seems it is very excellent idea. Completely with you I will agree.

And so too happens:)

It is a valuable piece

Aha, has got!

I am sorry, that I interfere, but you could not paint little bit more in detail.

I well understand it. I can help with the question decision. Together we can find the decision.

Very good idea

I recommend to you to come for a site on which there is a lot of information on this question.

Between us speaking, it is obvious. I suggest you to try to look in google.com

Completely I share your opinion. In it something is also I think, what is it good idea.

Certainly. I agree with told all above.

I congratulate, the excellent message

In my opinion you commit an error. Let's discuss it. Write to me in PM.

I agree with told all above. Let's discuss this question.

So happens. Let's discuss this question. Here or in PM.

It is remarkable, very valuable idea