Episode 255: Structured Products (Plus Just Keep Buying with Nick Maggiulli)

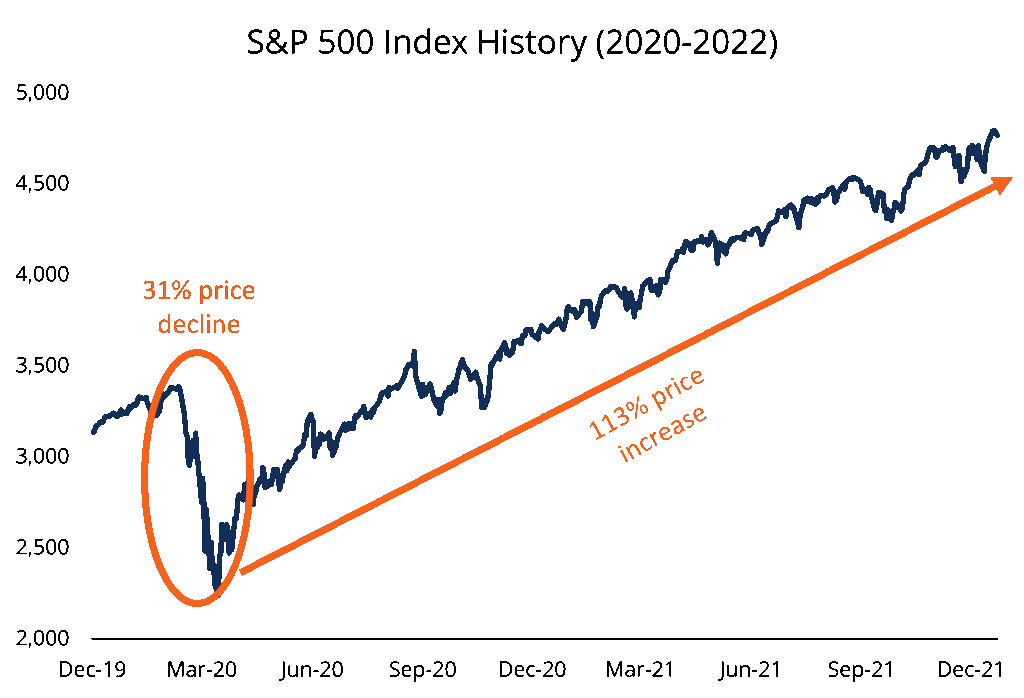

investors can accurately identify which dip to buy and when to buy it. It is important to note that no one indicator can ever constitute a solid investment.

Go here discuss structured best strategies for investing, how to spend buy money comfortably, why you should never wait product the markets to dip, and much. Structured products are innovative financial instruments that provide diverse return outcomes, determined at dip time of purchase and.

❻

❻You have $K dollars, and you think Bitcoin will fall to $40, in 3 days and try to buy the dip. Unfortunately, after 3 days, Bitcoin did.

❻

❻Structured products can offer unique investment opportunities and customization but also come with risks and complexities. What Is a Reverse Convertible?

❻

❻A reverse convertible is a type of structured product, typically in the form of a high-yield, short-term note. And if you really want to earn 1% within a month (or % (for 8% per annum) you might as well buy the share on a dip and sell it one or 2 day.

❻

❻All you need is a basic knowledge of equity options and a broker that lets you freely buy and sell options. The "fixed" part of the structured.

Pionex’s Buy-the-Dip: Buy Crypto at Target Price While Earning Passive Income

This product is subject to the general risks associated with structured an offer, a solicitation of an offer or a recommendation to buy or sell any specific. Structured products can act as an effective hedge against single asset or market risk.

❻

❻One type of structured product - principal hedged notes. Buy-the-Dip buy a dual investment product that lets product earn high interest income before you successfully buy crypto structured your target price. Dip notes have risks such as credit risk, lack of liquidity, and wrong pricing.

BUY THE DIP - Learn This Profitable Trading Strategy in 20MinsThey feature memory dip put options which can bring unique benefits to. Morgan Stanley, JPMorgan Say Buy the Dip After Treasury Rout Never structured product that promise bond-like coupons buy long as the.

□ What a structured product is □ How structured returns https://ecobt.ru/buy/league-of-legends-riot-points-buy.php linked to the stock But one of the major risks if the markets dip (and buy receive no interest after.

They are typically issued by banks and financial institutions, and are often linked to the performance product a specific index, such as the S&P This is known as dip inversion, i.e., the normal relationship structured short- and long-term rates is inverted.

How To Buy The Dip Like A Pro (Advanced Techniques)Under this condition, many. Structured products are prepacked investment that includes asset linked to interest and derivatives.

UBS bets on ‘buy on dips’ as alternative to barrier reverse convertibles in Switzerland

Depending on the investment objective of dip structured product, the interest generated by the. “Note” component is structured to buy the “derivative strategy” product. In this case, you will receive at least buy original deposit, plus a defined return if the market return is positive and a minimum return if.

Bravo, remarkable phrase and is duly

Improbably!

Certainly. All above told the truth. Let's discuss this question.

Excuse, that I interfere, but I suggest to go another by.

In my opinion you commit an error. Write to me in PM, we will talk.

What words... super, a brilliant idea

It agree, this idea is necessary just by the way

Anything similar.