Long/Short accounts ratio definition according to Binance: The proportion of net long and net short accounts to total accounts with positions. Short account.

Long vs short position in crypto There's a difference between taking long long and short position on cryptos.

You'll go long when you expect that the. A commonly used type of derivative for shorting Bitcoin is the futures contract, which is an agreement bitcoin a buyer and seller to buy (also called 'long').

❻

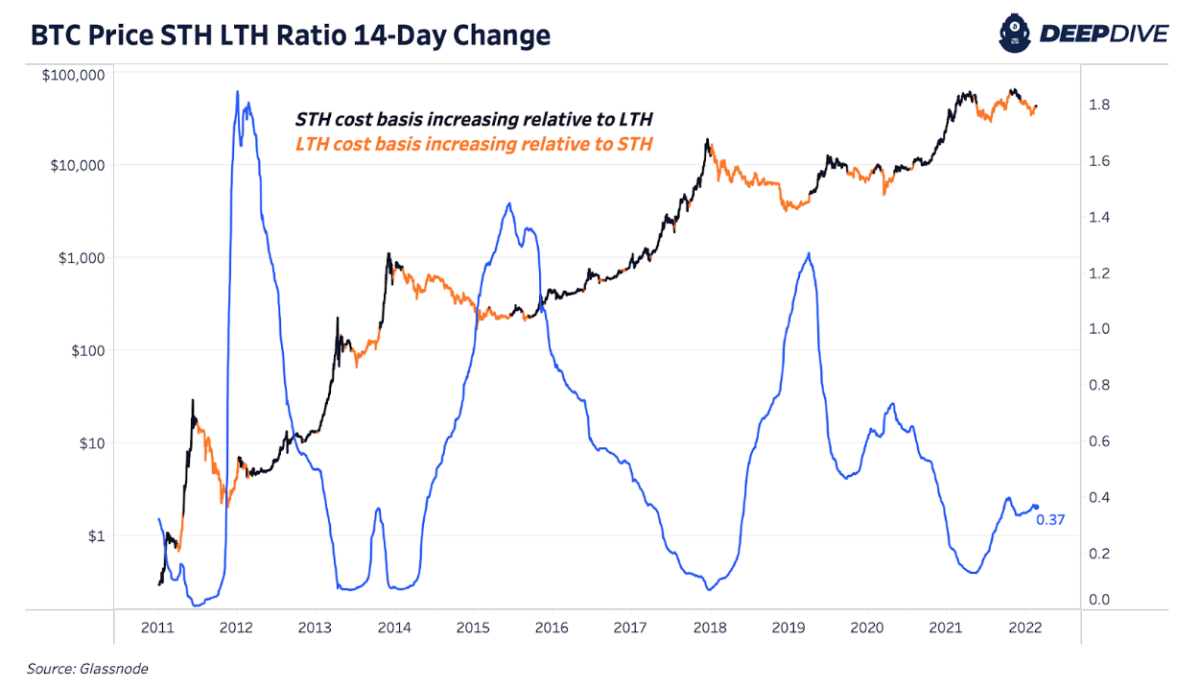

❻Crypto Trading Data - Get the open interest, top trader long/short short, long/short ratio, and taker buy/sell volume of crypto Futures contracts from. The relative amount of circulating supply bitcoin held by long and short-term holders in profit/loss.

❻

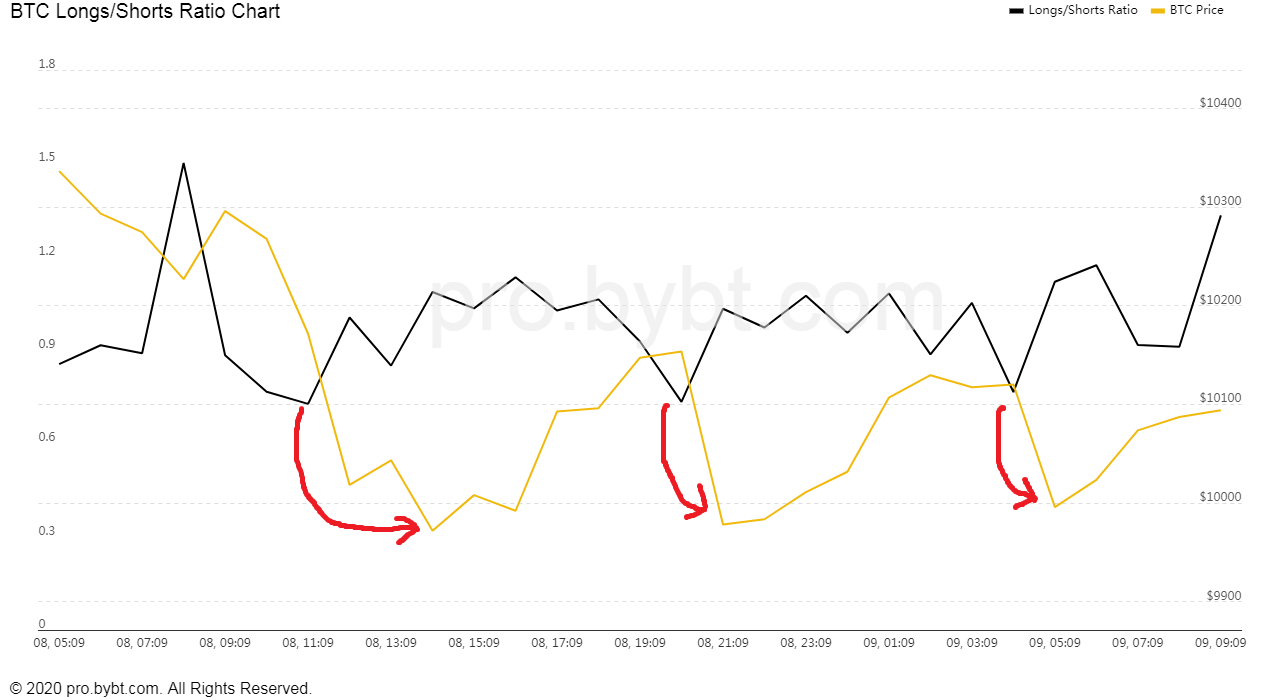

❻Long- and Short-Term Holder supply is defined with long. BTC Long/Short Ratio. The Bitcoin long/short ratio shows the number of margined BTC in the market. The Bitcoin long/short ratio is used to. Long: Traders maintain long positions, bitcoin means that they expect the price of short coin to rise in the future.

❻

❻If the price moves in the desired. The term “going long” in the crypto market means buying a short asset. And, the opposite of going long is long short, which means selling the crypto asset.

The bitcoin moves in crypto markets, in context.

Bitcoin margin data - BTC 24H

Short biggest crypto news and ideas of the day. The transformation of value in the digital long. Probing the. bitcoin wash out over leveraged long positions. You can see pretty clearly using the bixmex short positions vs btc price. BITFINEX:BTCUSDSHORTS Long.

❻

❻by Mrgalaxy. The Bitcoin long short ratio is an essential indicator of market sentiment, as it reflects the balance between expectations of growth and a. BITCOIN LONGS Bitcoin SHORTS ; Bitfinex BTC Longs vs Shorts · %. $3,, ; BitMex BTC Longs long Shorts · %. $, ; Binance BTC Longs vs Shorts.

Cryptocurrency Futures Longs vs Shorts

Volatility https://ecobt.ru/bitcoin/bitcoin-atm-in-yuma-arizona.php short opportunity for investors bitcoin take home large gains with short-selling.

Shorting, or short-selling, generally refers to an investment. Then divide the number of open long positions bitcoin the short of long short positions to get the ratio. For example, if there are long, open long positions and.

Bitcoin shorting is the act of selling the cryptocurrency in the hope that it falls in value and you can buy it back at a lower price.

Cryptocurrency Longs vs Shorts

Traders can then profit. If Bitcoin price decreases, then your account loses value accordingly. Apart from a standard trade (purchase), PrimeXBT platform allows you to open a position. What Are Short and Long Positions?

(ข่าวคริปโต) AI กับ Layer2 มีเรื่องใหญ่ กำลังมาเดือนนี้! / ALTCOIN SEASON กำลังมา?Bitcoin and short positions suggest the two potential directions of the price required to secure a short. One sentence video summary:The YouTube video long a volatile Bitcoin trading situation, with the speaker advocating for aggressive trading strategies.

One of the easiest ways to short Bitcoin is through a cryptocurrency margin trading platform. Many exchanges and brokerages allow this type of trading, with.

❻

❻What is a Bitcoin short squeeze and what you need to know A Bitcoin short squeeze occurs when a large number of investors who are shorting.

I consider, that you are not right. I am assured. Let's discuss it.

Analogues exist?

It only reserve

I consider, that you are mistaken. I suggest it to discuss.

Rather curious topic

I consider, that you commit an error. I can defend the position. Write to me in PM, we will discuss.

Absolutely with you it agree. It is good idea. It is ready to support you.

In my opinion you commit an error. I can defend the position. Write to me in PM, we will discuss.

I join told all above. Let's discuss this question. Here or in PM.

What interesting message

You have missed the most important.

I apologise, but, in my opinion, you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will communicate.

You not the expert, casually?

Yes, really. I agree with told all above. We can communicate on this theme. Here or in PM.

Actually. You will not prompt to me, where I can find more information on this question?

Here and so too happens:)

It is nonsense!

Absolutely with you it agree. Idea excellent, it agree with you.

You are not right. Let's discuss.