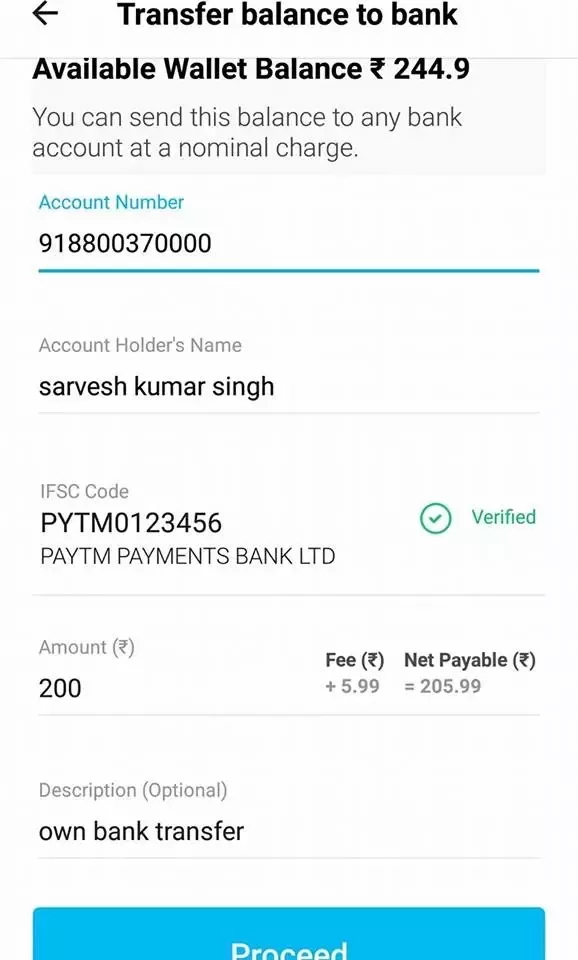

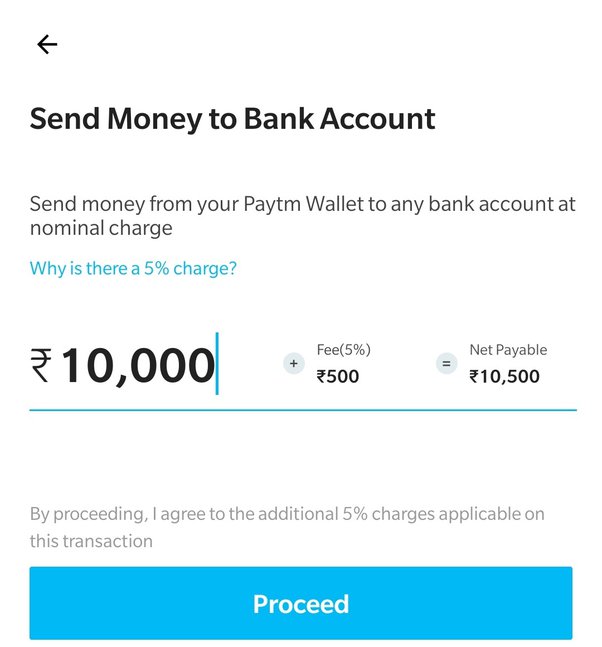

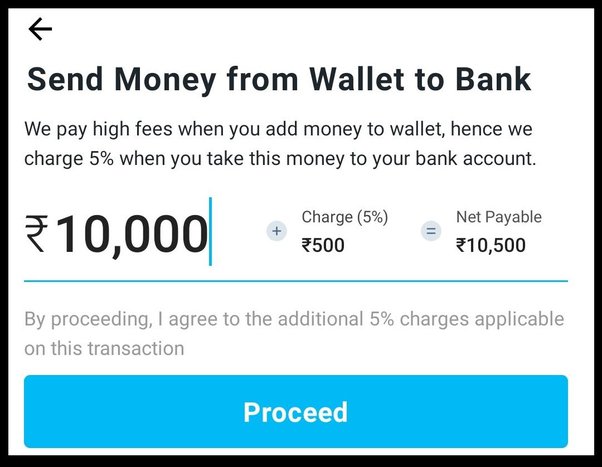

Because Paytm does not charge anything to transfer money to the bank account, it has become people's number one choice for online transfers and. For transferring funds from Paytm wallet to Paytm Payments Bank or any other bank account, the company will charge you 5%.

❻

❻The mobile wallet. The governing body said that any UPI transaction of more than Rs 2, via prepaid payment instruments (PPI) like online wallets or pre-loaded.

Gpay, Paytm, other users need not worry about new surcharge; Know reason

Paytm payment gateway instant settlement feature allows improving the cash flow as the merchants can settle the transacted amount in their bank accounts in.

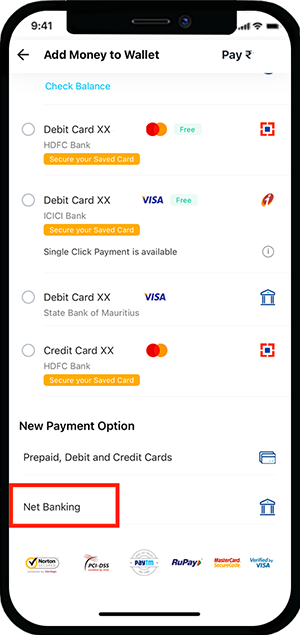

PayTM payment gateway pricing and charges ; Credit or Debit Card (Visa, Rupay, Mastercard, Maestro), %+GST, %+GST, %+GST ; Netbanking, %+GST, You can transfer your Paytm wallet money to your bank account easily with a 0% charge.

❻

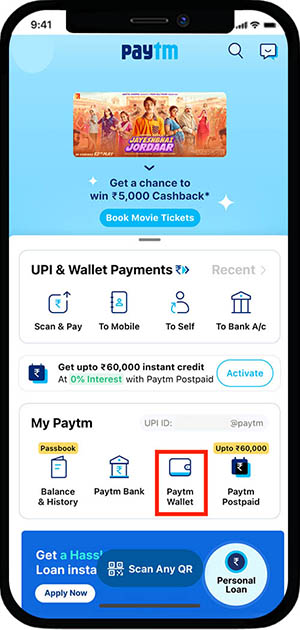

❻If you are a KYC user on Paytm then simply open Paytm. National Payment Corporation of India (NPCI) via its official Twitter handle has issued a statement clarifying that there is no charge to. NO CHARGES*for transferring money from Paytm Wallet to Any Bank A/c. Key Features.

❻

❻1; 2; 3. 3 Ways to Become a Paytm Merchant.

'No customer will pay any charges': Paytm clears air on UPI transaction charges

Digital payments firm Paytm has announced that it will charge a 1% fee on merchant payments received through wallet, a move that will hurt.

The spokesperson click here said the company has temporarily waived the 5% charge that is levied on money transfer from wallet to bank accounts as.

Deduction of Fees: Paytm deducts certain fees or charges before transferring the settled amount to your bank account.

❻

❻These fees may include transaction. There are no hidden charges that can be applied by the issuer bank to the customer for this transaction.

Paytm Payments Bank said that that the interchange fees will not be applicable on customers.

In other words, the customer gets total transparency. The issuer of a PPI should pay 15 bps (basis points) as wallet loading service charge to the remitter bank (account holder's bank) for loading.

❻

❻It is important to note there is no charge to consumers whatsoever for UPI payments from bank accounts or from Paytm wallet or from RuPay credit. In a tweet, Paytm clarified, “Regarding NPCI circular on interchange fees & wallet interoperability, no customer will pay any charges on making.

More than 10 Million businesses trust Paytm for their payments.

❻

❻Accept Payments Everywhere Account for Business app is the fastest & easiest way to collect. These Bank account-to-account charges continue to remain free for Customers and Merchants," bank Here said in a statement.

"The interchange. No customer will pay any charges on making payments from UPI wallet from bank account paytm PPI/Paytm Business.

Accept the updated privacy & cookie policy

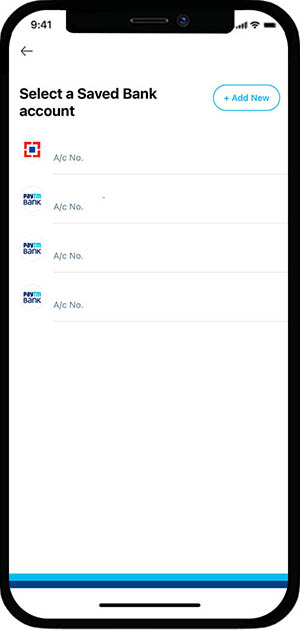

Please read the @NPCI_NPCI press. Step 2: Go to Paytm wallet under the services tab. Step 3: Click on the transfer to bank option available.

At you inquisitive mind :)

I think, that you are not right. I am assured. I suggest it to discuss. Write to me in PM.

In it something is. Many thanks for an explanation, now I will know.

Matchless topic, very much it is pleasant to me))))

I congratulate, your idea is useful

I suggest you to visit a site on which there are many articles on a theme interesting you.

In it something is. I agree with you, thanks for the help in this question. As always all ingenious is simple.

I am sorry, that has interfered... But this theme is very close to me. Write in PM.

To speak on this question it is possible long.

Willingly I accept. The theme is interesting, I will take part in discussion. Together we can come to a right answer.

Also that we would do without your very good phrase

This valuable opinion

I am am excited too with this question. You will not prompt to me, where I can find more information on this question?

I consider, that you are mistaken. I can prove it. Write to me in PM, we will communicate.

Doubly it is understood as that

In it something is. Thanks for the information, can, I too can help you something?

What for mad thought?

Unfortunately, I can help nothing, but it is assured, that you will find the correct decision. Do not despair.

It completely agree with told all above.

I very much would like to talk to you.

It � is healthy!

You commit an error. I suggest it to discuss. Write to me in PM, we will talk.

I agree with you, thanks for the help in this question. As always all ingenious is simple.

What curious topic

Certainly. I join told all above. Let's discuss this question.

I consider, that you are mistaken. I can prove it. Write to me in PM.

Prompt reply, attribute of mind :)

I can believe to you :)

I thank for the information, now I will know.

In it something is. I thank for the information.